The shares of the FTSE 250-listed British housebuilder Redrow PLC (GB:RDW) surged yesterday after the company reported higher pre-tax profits for FY23 but issued a weak outlook. The company reduced its revenue and profit forecast for FY24, reflecting the challenges faced by the UK housing sector due to elevated mortgage rates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nonetheless, investors reacted positively to the current year’s numbers, which pushed the Redrow share price up by 6.54% on Wednesday. Despite the sluggish housing market, the company’s stock has maintained stability and managed to secure a modest gain of 10% YTD.

Redrow PLC is a real estate company focused mainly on developing residential properties across the UK. The company is known for its premium and high-quality projects.

Let’s take a look at some of the numbers.

FY23 Earnings: Resilient Performance

Redrow’s revenue growth was almost flat at £2.13 billion compared to £2.14 billion in 2022. The company finished 5,436 homes in FY23, representing a 5% decrease compared to 5,715 homes completed in FY22. However, revenue remained steady, thanks to the increase in the average selling price. The statutory profit before tax grew by 61% to £395 million, as last year’s numbers were impacted by fire safety provisions. The underlying profit before tax fell 4% to £395 million in FY23, hit by higher costs.

Moving onto shareholders’ returns, the company has declared a final dividend of 20p per share, bringing the total dividend for the year to 30p per share. This was 9% below the dividends paid last year.

FY24 Guidance: Painting a Weak Outlook

Redrow’s order book of £850 million is 41% down from the previous year, highlighting the challenging business conditions. The company expects its FY24 revenue to be between £1.65 billion and £1.7 billion. Profit before tax is expected in the range of £180 million to £200 million, marking a decline compared to the previous year’s figure of £395 million.

In a setback to shareholders, the company also mentioned its intentions to cut its dividend to 14p per share.

On a positive note, the market slowdown has also impacted building cost inflation. Redrow expects building costs to rise by 4% in FY24, which is a significant reduction compared to the 8% increase in the previous period.

What is the Target Price for Redrow Share?

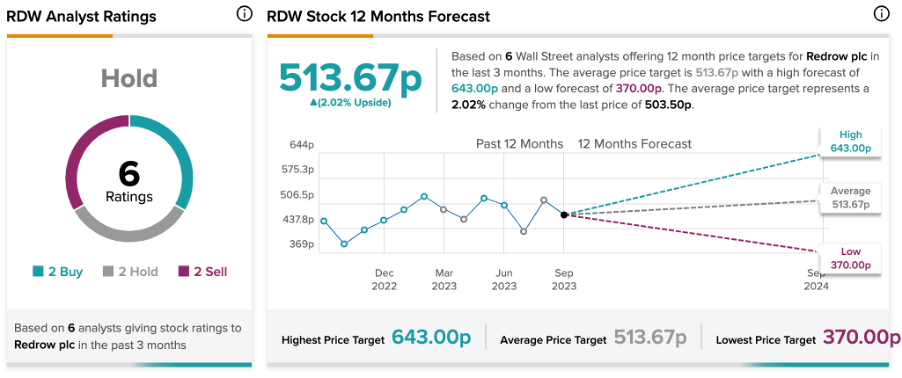

On TipRanks, RDW stock has been assigned a Hold rating based on two Buy, two Hold, and two Sell recommendations. The Redrow share price target of 513.7p offers a modest upside potential of 2%.

It’s worth mentioning that these ratings were assigned in the previous month and may be subject to changes following the company’s cautious outlook.