The Crest Nicholson Group’s (GB:CRST) stock tumbled on Monday after the company issued a profit warning hit by the slowdown in the housing sector. The company cautioned that its profits would fall significantly short of previous expectations.

The stock was trading down by over 8% on Monday at the time of writing, which was a continuation of the existing trend of falling share prices. The shares have experienced a decline of around 30% in the last three months.

The shares of other housebuilders in the UK were also trading in the red zone following the discouraging data. Barratt Developments PLC (GB:BDEV) fell by 2.4%, Taylor Wimpey PLC (GB:TW) was down by 3.8%, and Persimmon PLC (GB:PSN) by 2.5% at the time of writing.

Crest Nicholson is a prominent property developer in the UK with over six decades of experience in new home construction.

Weaker Outlook

After initially anticipating a profit of £73.7 million in June, the group has revised its projection to a mere £50 million. The company is not expecting trading conditions to improve before its full-year earnings due to issues like high inflation, more rate hikes, and higher wages.

The recently released data from real estate portal company Rightmove PLC (GB:RMV) prompted this announcement. Rightmove revealed a significant drop in home prices for homes across the UK this month. The increase in mortgage costs has led sellers to adjust their expectations regarding the potential value of their properties.

Even though the weakness of the housing sector is not a surprise for investors, this decline from the company indicates the extent of its influence on housebuilders.

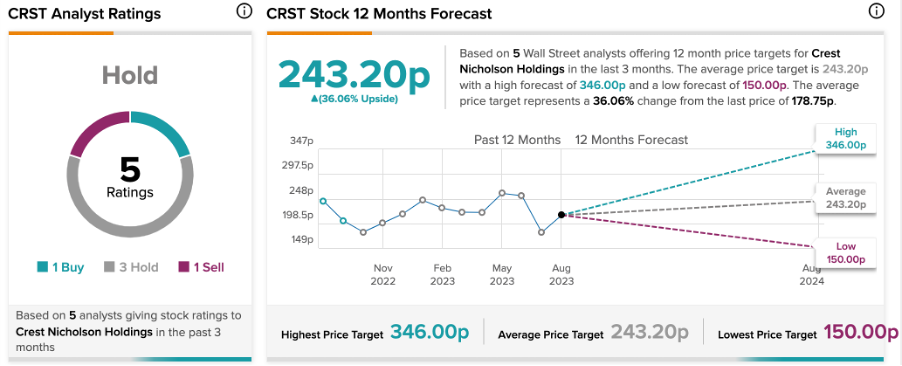

Analyst Glynis Johnson from Jefferies said that the company’s projected profit shortfall is likely to catch investors off guard. Johnson has a Buy rating on the stock with a target price of 346p, implying a huge upside of 93% in the share price.

What is the Target Price for Crest Nicholson?

According to TipRanks, CRST stock has a Hold rating based on one Buy, three Hold, and one Sell recommendation.

The average target price of 243.2p is 36% higher than the current trading level.