The share price of FTSE-100-listed Beazley PLC (GB:BEZ) declined by more than 6% yesterday after the company published its first-half earnings report. Beazley achieved a historic profit of $366.4 million in the first half and is on track to fulfill its full-year growth and combined ratio guidance.

Despite posting profits, the results prompted a negative response in the stock price, which went down by 6% yesterday. Overall, the stock remains volatile due to the cyclical dynamics of the industry. YTD, the Beazley share price experienced a loss of almost 16% in trading.

Beazley is a specialized insurance company that has been providing underwriting and claims services to its global clients for the last 30 years.

Stable Numbers

In the first half of earnings, the insurance premiums written expanded by 13% to $3 billion as compared to the same period in 2022. The company’s profit before tax of $366 million was on the same lines as last year. The company’s growth was driven by its expansion in the North American property division and improved cyber insurance in Europe.

The company reported a discounted combined ratio of 84%, compared to 71% in the first half of 2022. Monitoring the combined ratio is a valuable practice as it serves as an indicator of insurance business profitability. When the figure falls below 100, it signifies that the insurance operations have been profitable. The increase in this ratio from 71% to 84% for Beazley signifies lower profitability for the company.

In terms of outlook, the company affirmed its commitment to achieving the full-year growth and combined ratio targets as planned. The company restates its full-year combined ratio guidance based on IFRS 4, which stands in the high eighties.

Is Beazley Stock a Good Buy?

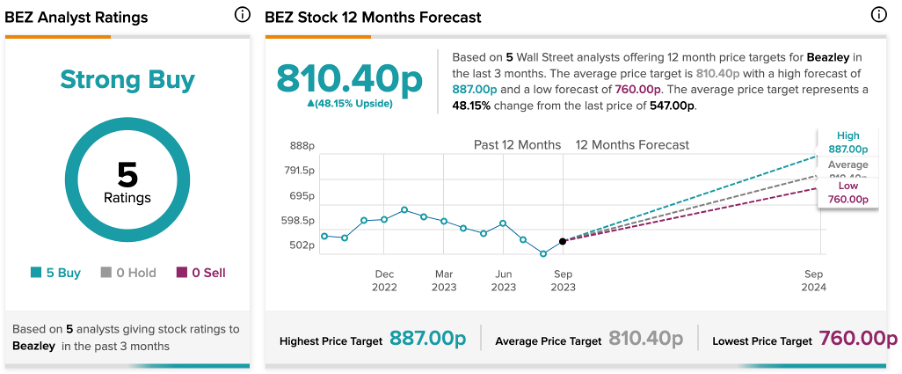

As per the consensus of analysts on TipRanks, BEZ stock holds a Strong Buy rating, supported by unanimous Buy recommendations from five analysts.

Post-results, yesterday, analyst Ivan Bokhmat from Barclays assigned a Buy rating to the stock, predicting a 40% growth in the share price. Bokhmat is a four-star-rated analyst on TipRanks and mainly covers insurance stocks in the global markets.

Today, J.P. Morgan analyst Kamran Hossain reiterated his Buy rating on the stock and forecasted a growth rate of 43%.

The Beazley share price forecast is 810.4p, which is 48.15% higher than the current trading level.