The UK-based Ashtead Group PLC’s (GB:AHT) shares declined by 10% yesterday after the company reduced its revenue and profit forecast for the full year. The company stated in its trading update that it now expects its annual revenues to grow in the range of 11% and 13%, compared to its earlier forecast of 13% and 16%. It also anticipates its EBITDA to be 2%-3% lower than market expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ashtead is set to disclose its second-quarter and first-half results for the period ended on October 31 on December 5, 2023.

Ashtead Group specializes in renting construction and industrial equipment to a diverse range of customers. The company operates under the name of Sunbelt Rentals in the U.S., the UK, and Canada.

Gloomy Outlook

The company attributed the downward revision of guidance to fewer natural disasters in its key market, the U.S., and reduced demand for its services amid the Hollywood writers’ strike.

The company provides its equipment during major disasters in North American markets which contributes to more than 90% of its revenues and profits. However, the company witnessed slower activities in its emergency response business in the second quarter, which is expected to continue in Q3 as well. Overall, the U.S. experienced fewer wildfires and a quieter-than-usual hurricane season, impacting the company’s business. Ashtead’s operations were further hit by the Hollywood actors’ and writers’ strikes, affecting its film and television business in Canada.

Additionally, the company is looking at a full-year depreciation charge of $2.1 billion and a net interest cost of $540 million, impacting its adjusted profit before tax for the full year.

On the plus side, the company sees these reasons as one-off events and remains confident in its markets in North America, driven by big construction projects.

Are Ashtead Shares a Good Buy?

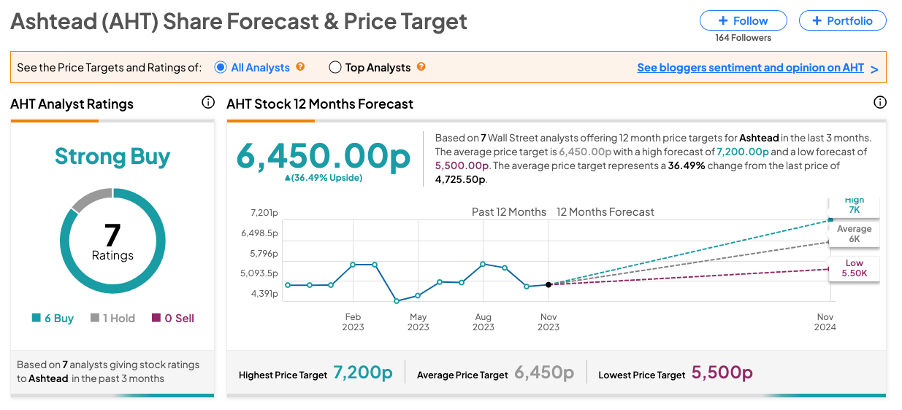

On TipRanks, AHT stock has received a Strong Buy rating based on six Buy and one Hold recommendation. The Ashtead share price target is 6,450p, which is 36.5% higher than the current trading levels.