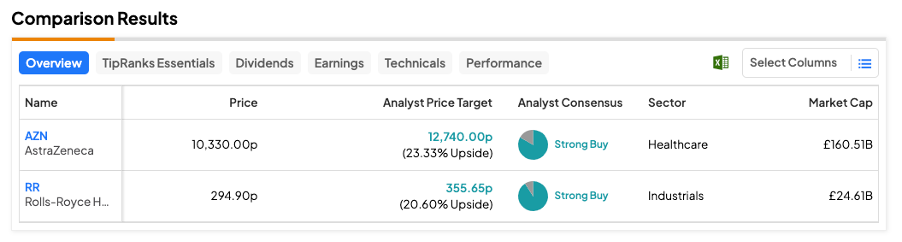

The FTSE 100-listed AstraZeneca PLC (GB:AZN) and Rolls-Royce Holdings PLC (GB:RR) have been rated as Strong Buy by analysts, indicating their long-term growth potential. AstraZeneca exhibits a share price growth potential of 23%, while Rolls-Royce indicates an upside of approximately 20%.

TipRanks’ Strong Buy rating serves as a guide for selecting stocks that have the potential for long-term returns. Additionally, TipRanks provides a wide range of tools, including Stock Comparison and Top Dividend Shares, to assist in the selection of stocks across various markets.

Let’s take a look at these two stocks in detail.

AstraZeneca PLC

AstraZeneca is a leading pharmaceutical company catering to billions of people globally. The company operates under three categories: Oncology, Rare Diseases, and BioPharmaceuticals.

The stock remains a favorite among analysts, considering its strong brand value and a solid portfolio of drugs. The company has around 167 projects in its pipeline in different stages of development.

Last month, the company also raised its annual profit outlook during its Q3 2023 results, backed by the performance of its cancer drugs. The company now anticipates a low-teens percentage (at constant currency) increase in total revenue, excluding COVID drugs, up from the prior guidance of a low double-digit rise. Also, the core EPS is expected to grow by a low double-digit to low-teens percentage, a notable change from the previous projection of a high single-digit to a low double-digit growth rate.

Is AstraZeneca a Buy or Sell?

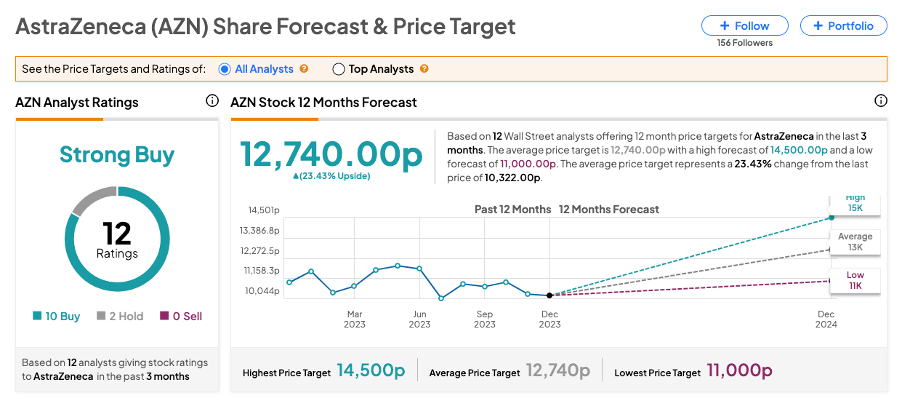

As per the consensus rating on TipRanks, AZN stock received a Strong Buy rating, supported by 10 Buy and two Hold recommendations. The AstraZeneca share price forecast stands at 12,740.0p, signifying a potential upside of 23.4% in the share price.

Rolls-Royce Holdings PLC

Rolls-Royce is a manufacturing company specializing in designing engines and power systems for the aerospace and defense industries.

Year-to-date, the company’s stock has demonstrated remarkable growth, registering an increase of around 190% in trading. This growth is driven by higher sales and profits in 2023, supported by the company’s effective turnaround strategy and a rise in global defense spending.

Looking ahead, analysts hold a bullish view of the stock, considering the overall strong prospects of the defense sector in 2024 and the company’s ambitious goals. On its Investor Day, held in November, the company revealed its mid-term targets to achieve operating profit in the range of £2.5 to £2.8 billion. Additionally, the company envisions its free cash flow to grow between £2.8 and £3.1 billion, coupled with the aim to achieve a return on capital in the range of 16% to 18%.

Rolls-Royce Share Price Prediction

According to TipRanks, RR stock has received a Strong Buy consensus rating based on 10 Buys and one Hold recommendation. The Rolls-Royce share price forecast is about 352.48p, which is 19.5% higher than the current trading level.