In major news on French stocks, Kering SA (FR:KER) issued a profit warning for the first half of 2024 after Gucci’s comparable sales plummeted by 18% in Q1 2024, primarily due to weakened demand in China. Kering announced in a statement on Tuesday that recurring operating income is expected to decrease by 40% to 45% in the first half. According to Bloomberg estimates, analysts had projected a decline of 24% to 30% in the first-half operating profit.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Year-to-date, Kering stock has traded down by 11%.

Kering is a luxury goods manufacturer with brands like Gucci, Saint Laurent, Bottega Veneta, Balenciaga, and more in its portfolio.

Gucci’s Weakness Marks Tough Q1 for Kering

In the first quarter, Kering reported a 10% decline in its revenue to €4.5 billion on a comparable basis. Gucci, the company’s largest brand, saw its revenue decrease by 18% on a comparable basis and by 21%, as reported, to €2.08 billion. The brand’s performance was mainly impacted by sluggish demand in Asia Pacific, especially in China.

Kering experienced an 11% decline in revenue from its directly operated retail network on a comparable basis. This weakness was attributed to decreased store traffic. Revenue in the Wholesale and Other segment decreased by 7% on a comparable basis.

Kering’s performance mirrored the continued deceleration in the luxury sector over the past year. Sales were impacted as a growing number of affluent consumers curtailed their spending on Gucci products. Additionally, Gucci faced challenges as Chinese shoppers awaited the arrival of its new collection in stores. However, the company noted that Gucci’s new collections, which have been gradually introduced since mid-February, have been exceptionally well received, particularly in the ready-to-wear and shoes categories.

Moving forward, Kering will continue to invest in its brands but does not anticipate significant improvement in Gucci’s sales in the second quarter.

Is Kering a Good Stock to Buy?

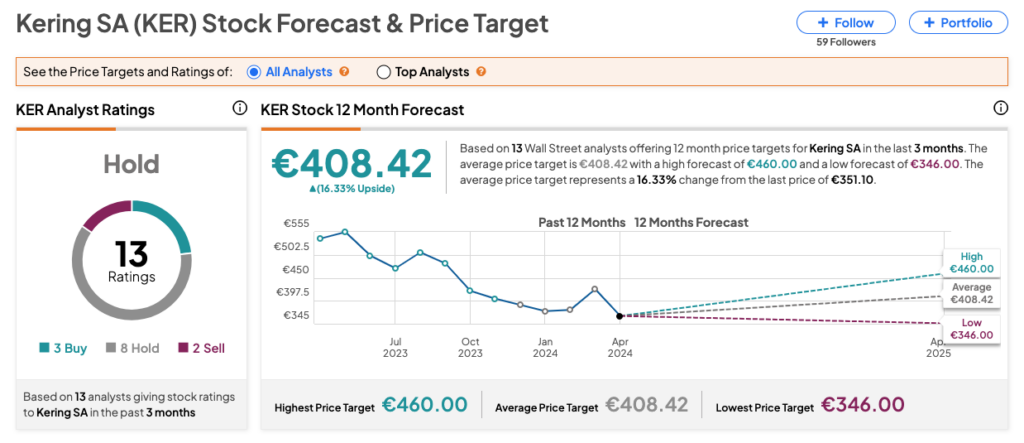

On TipRanks, KER stock has received a Hold rating based on three Buy, eight Hold, and two Sell ratings. The Kering share price target is €408.42, which is 16.3% above the current level.