DAX 40 companies Daimler Truck Holding AG (DE:DTG) and Siemens Healthineers AG (DE:SHL) have received Buy ratings from analysts. Both companies have recently published their quarterly earnings for 2023, and experts are now more optimistic about the future rise of their share values.

According to the TipRanks Trending Stocks tool for Germany, these stocks were recently on the radar of analysts and were re-rated as Buys by them. This tool presents a comprehensive list of stocks in a specific market that analysts have evaluated within the past 30 days. Additionally, we can refine the list by filtering for market capitalization and the sector in which the company operates.

Let’s discuss these German stocks in detail.

Daimler Truck Holding AG

Based in Germany, Daimler Truck AG is among the largest manufacturers of commercial vehicles globally.

The company recently announced its Q1 earnings for 2023, exceeding expectations. The company posted strong performance, driven by higher demand and a pricing policy that offset the cost headwinds. Daimler posted earnings of €1.16 billion, higher than the consensus estimate of €976 million. It maintained the outlook for the full year unchanged at €55-€57 billion in revenues.

Post-results, analysts are upbeat on the future prospects of the stock and have re-confirmed their ratings.

Among these, RBC Capital analyst Nicholas Housden has the highest price target of €53, which implies a huge upside potential of more than 80%. Three days ago, Housden maintained his Buy rating on the stock.

Is Daimler Truck Stock a Buy?

According to TipRanks’ analyst consensus, DTG stock has a Strong Buy rating backed by eight Buy versus two Hold recommendations.

The DTG average target price is €42.1, which is 45% higher than the current trading levels.

Siemens Healthineers AG

Siemens Healthineers AG, which operates as a subsidiary of Siemens AG, is a medical technology firm that specializes in designing and developing diagnostic imaging systems.

In its recently released earnings for the second quarter of 2023, the company posted a 30% decline in second-quarter operating profit due to decreasing demand for COVID-19 tests. The company expects its diagnostic unit’s revenue to decline by 23-26% for the full year. This is a change from the previous forecast of a 19%-21% decrease.

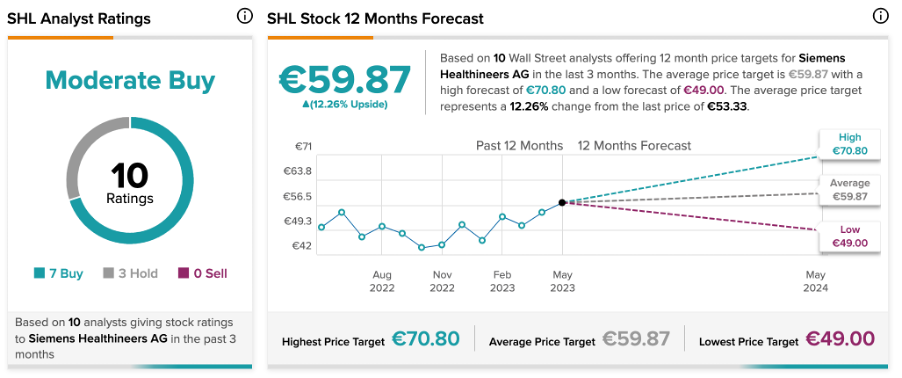

J.P. Morgan analyst David Adlington, who has a Buy rating on the stock, stated that the diagnostic segment was a primary source of disappointment in the results. Adlington still remains bullish on the long-term aspects of the company and reiterated his Buy rating two days ago. His price target of €70.8 represents a growth potential of 32.2% in the share price.

Yesterday, analyst Falko Friedrichs from Deutsche Bank also re-rated the stock as Buy and predicted an upside of 20%.

Is Siemens Healthineers a Good Stock to Buy?

According to TipRanks, the average price target for SHL stock is €59.87, indicating a potential increase of 12.3% from the current price level. The stock has a Moderate Buy rating on the platform, based on seven Buy and three Hold recommendations.

Conclusion

DTG stock has garnered strong support from analysts, who forecast a 45% increase in its share price. In contrast, SHL has received a Moderate Buy rating with a 12% potential upside, according to analysts.