Shares of Diageo PLC (GB:DGE) were down 3.5% as of writing after the alcoholic beverage maker reported weak performance in H1 FY24. Diageo’s first-half sales and profits came in below expectations, hit by lacklustre demand in the Latin America and Caribbean (LAC) region. LAC accounts for 11% of the group’s total sales.

FTSE 100-listed Diageo is a multinational alcoholic beverage company that owns renowned brands such as Johnnie Walker, Guinness, Smirnoff, Baileys liqueur, and Captain Morgan rum. DGE shares have lost over 19% in the past year.

Diageo’s H1 FY24 Results

In H1 FY24, Diageo’s sales fell 1.4% to $11 billion, owing to a 23% decline in LAC sales. Excluding LAC, organic net sales grew 2.5% year-over-year. Meanwhile, operating profit declined 11.1%, as the first-half operating margin contracted by 329 basis points due to higher marketing expenses, dismal LAC results, and one-time operating charges.

CEO Debra Crew blamed the “uneven global consumer environment” for Diageo’s weak H1 FY24 performance. Crew added that price-sensitive consumers and higher inventory levels at retailers impacted LAC’s performance, with adverse conditions expected to continue in H2 FY24. Consequently, organic net sales in LAC are expected to fall by 10% to 20% in the second half of Fiscal 2024. Having said that, Crew added that the company is taking measures to reduce inventory levels in the LAC region to match the current consumer environment.

On a positive note, Diageo’s free cash flow grew in H1 FY24 and the company boosted its interim dividend by 5% to 40.50 cents per share. Going forward, Diageo expects the group’s organic net sales growth rate to improve gradually in the second half compared to H1 FY24.

Is Diageo a Buy, Sell, or Hold?

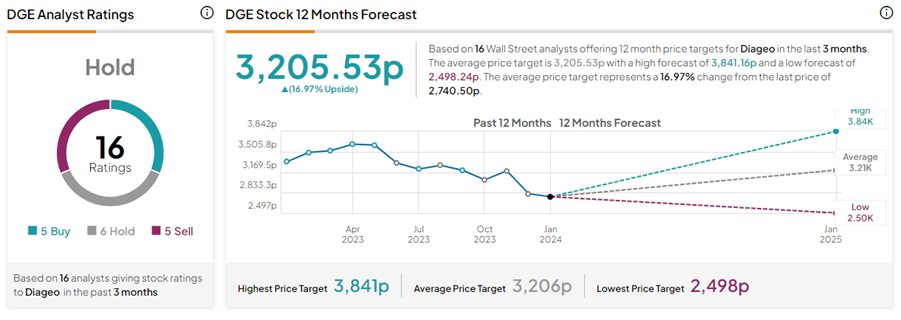

Following the results, J.P. Morgan analyst Celine Pannuti maintained a Hold rating on DGE shares with a price target of 3,500p.

Similarly, Bank of America Securities analyst Andrea Pistacchi reiterated a Hold rating on DGE with a price target of 3,000p.

On TipRanks, DGE stock has a Hold consensus rating based on five Buys, six Holds, and five Sell ratings. The Diageo PLC share price forecast of 3,205.53p implies 17% upside potential from current levels.