The collapse of SVB Financial Group followed by UBS’ (NYSE:UBS) takeover of Credit Suisse (NYSE:CS) jolted investors worldwide, which was reflected in the banking stocks.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Deutsche Bank (DE:DBK) was the latest to bear the burden, with its stock value losing almost 20% in March. Later on, the shares rebounded after the bank assured its investors that it was in sound health.

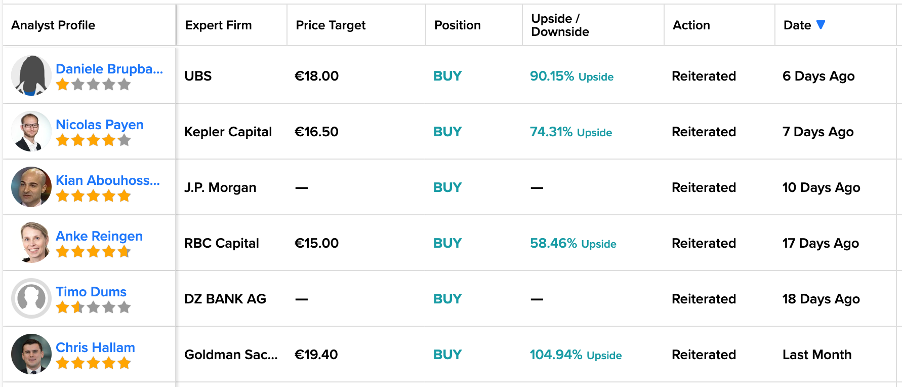

Using the TipRanks Analyst Forecast page for Deutsche Bank, we have listed some of the analysts and their views on the stock. Let’s dig deeper.

Analysts’ View

YTD, the shares have been trading down by 12.5%. However, analysts are still confident about the stock and feel it is at an attractive entry point.

Daniele Brupbacher from UBS has increased his price target from €16.3 to €18.8 while maintaining the Buy rating. This means a huge upside of 88% on the current price. Brupbacher also raised his 2023 earnings per share estimate for the bank based on higher expected income.

Recently, Kepler Capital analyst Nicolas Payen also reiterated his Buy rating on the stock, suggesting an upside of 72%. Payen stated that the bank has “very solid” fundamentals and is “not the ‘weak link” in the European banking landscape.”

Analysts also believe that the bank’s financial health has improved a lot in recent years. The bank has focused on reducing its debt and improving its capital position, along with achieving higher profits.

Citigroup analyst Andrew Coombs commented on the decline of shares, stating, “None of the reasons appears significant enough to explain the move, rather we view this as an irrational market.”

Coombs has a Hold rating on the stock with a price target of €13.5, which implies an upside of 41% on the current price. He also added that the bank is profitable and has liquidity on its balance sheet.

In February, the bank reported its 2022 earnings with its 10th consecutive quarter of profits. The bank’s net profit of €5.7 billion in 2022 was the highest since 2007 and more than doubled as compared to 2021.

Deutsche Bank Share Price Forecast

Overall, DBK stock has a Moderate Buy rating on TipRanks based on a total of 13 recommendations.

The average price target is €14.29, which is almost 50% higher than the current price level.

The Bottom Line

The recent banking turmoil has triggered investors’ concerns, leading to volatility in the stock markets.

Analysts feel investors could use this slump as a buying opportunity to hold on to some high-quality shares like DBK at lower prices. Based on the analysts’ confidence and their Buy ratings, DBK shares could be a great investment option at the current trading price.