German bank Deutsche Bank AG (DE:DBK) is all set to announce its second-quarter and first-half earnings for 2023 tomorrow, July 26. Despite analysts’ expectations of higher revenues, the bank’s earnings are projected to be affected by increased costs. Based on analysts’ evaluations, the stock has a Moderate Buy rating, offering more than 30% potential upside.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Upcoming Earnings

The consensus EPS forecast for the second quarter is €0.58 per share, surpassing the EPS of €0.33 reported in Q2 2022. According to analysts, revenue for the quarter is expected to be around €7.06 billion. This would signify a rise compared to the total revenue of EUR 6.65 billion reported by the bank in the same period last year.

The net profit is also expected to fall from €1.05 billion in the last year to €713 billion in this quarter. The profits will be mainly hit by the higher costs of restructuring and litigation. The total costs are anticipated to be between €600 and €700 million. The bank also announced that it is expecting a significant year-on-year decrease in fixed-income trading revenue at its investment bank.

Analysts also added that there could be a buyback announcement worth €100 million for the second half of the year.

Analysts’ View

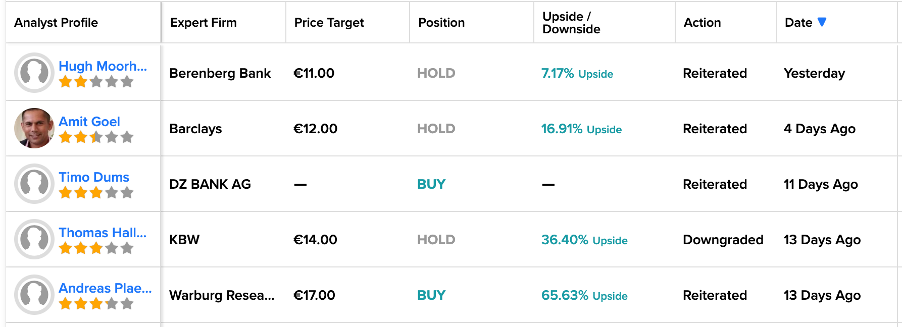

Yesterday, ahead of its earnings, Berenberg analyst Hugh Moorhead confirmed his Hold rating on the stock, forecasting a growth of 7% in the share price.

Three days ago, Amit Goel from Barclays also reiterated his Hold rating on the stock, with a higher projection of 17% growth.

Among these analysts, Warburg Research analyst Andreas Plaesier is highly bullish on the stock and is projecting 65% growth in the shares. Plaesier said that the “group’s quarterly revenue growth is expected to be driven by both the corporate and the private banks.” He also predicts that total non-interest expenses for the quarter will increase by 16% year-on-year to reach EUR 5.64 billion.

He confirmed his Buy rating on the stock 13 days ago.

Deutsche Bank Share Price Forecast

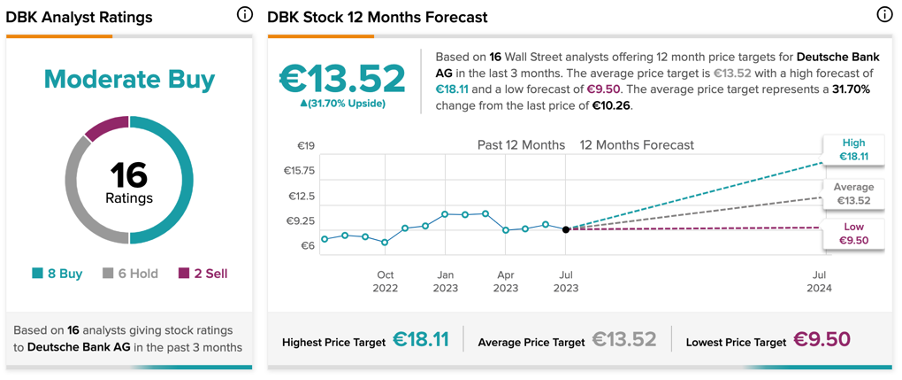

According to TipRanks’ analyst consensus, DBK stock has a Moderate Buy rating. The stock has a total of 16 recommendations, of which eight are Buy.

The average share price forecast is €13.52 which is 31.7% higher than the current price level.