Deutsche Bank AG (DE:DBK) has been on the radar of the German regulator, the Federal Financial Supervisory Authority (BaFin), amid the challenges of integrating its retail unit, Deutsche Postbank. This complex migration project, aimed at streamlining operations and enhancing efficiency, has taken a toll on the bank’s reputation as customers faced disruptions and access issues.

These issues led to a series of complaints and, ultimately, regulatory scrutiny. BaFin stepped in to address the situation and emphasized the need for a swift resolution of these issues to prevent further harm to customers and the bank’s reputation. The bank’s recent public rebuke from BaFin highlights the critical need for financial institutions to prioritize customer protection during IT migrations.

The Backdrop

Deutsche Bank took full control over Postbank in 2010 and started the integration process with the aim of generating additional cost savings. In July 2023, the bank finally migrated the data, and all 19 million customers were on a single platform.

However, despite meticulous planning and preparations, the IT migration didn’t go as smoothly as envisioned. It faced backlash as social media platforms buzzed with complaints from irate customers. Customers reported various disruptions and inconveniences, including delayed transactions and technical glitches. The customer frustration reached its peak when they were unable to access their accounts or complete transactions, causing significant inconvenience.

The Road Ahead

Deutsche Bank’s IT migration woes have proven to be more enduring than initially anticipated. Recently, the bank issued a cautionary statement, indicating that the resolution of the remaining IT problems may extend beyond a three-month period, prolonging the period of customer disruption.

In response to the prolonged disruptions and customer complaints, BaFin is considering taking formal action against Deutsche Bank. The financial watchdog has hinted at the possibility of imposing sanctions, which could include fines.

Deutsche Bank now faces the daunting task of regaining the trust of its customers and restoring its reputation. While the bank has promised to rectify the situation, it remains to be seen how quickly it can regain customer trust and put this challenging chapter behind it.

Deutsche Bank Share Price Forecast

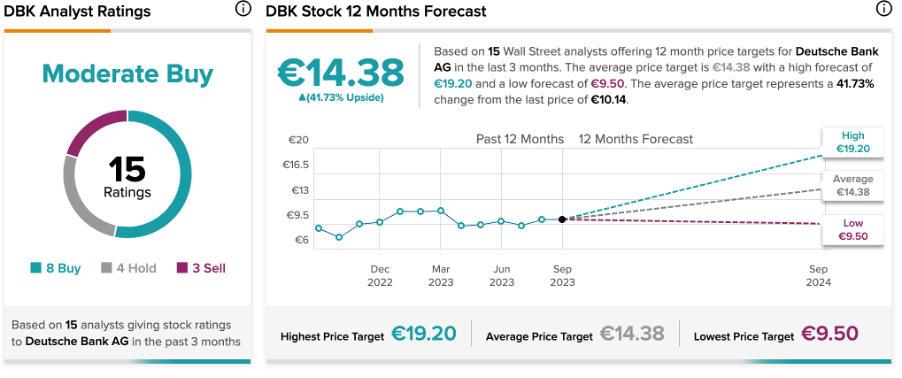

According to TipRanks’ analyst consensus, DBK stock has received a Moderate Buy rating backed by eight Buy, four Hold, and three Sell recommendations. The Deutsche Bank share price forecast is €14.38, which is 41% higher than the current price level.

Year-to-date, the stock has lost around 4% in trading.