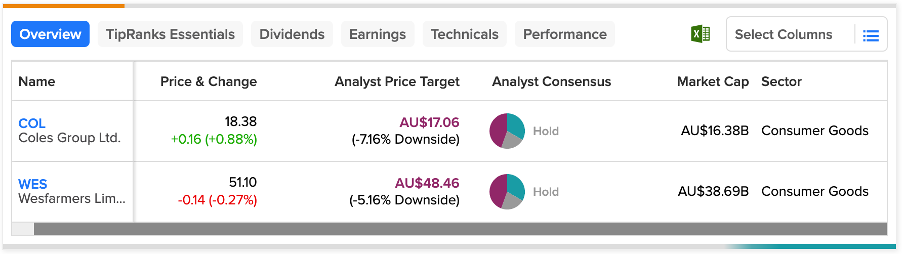

ASX-listed companies Coles Group Ltd. (AU:COL) and Wesfarmers Limited (AU:WES) have been rated as Hold by analysts. In addition, the forecasted price target is lower than the current price level for these companies.

Here, we have used TipRanks Stock Screener to pick these stocks from the Australian market that match our criteria.

Let’s have a look at more details.

Coles Group Limited

The Coles Group is a popular retailer in Australia, operating a chain of supermarkets, liquor stores, and more.

The company declared its first-half results for 2023 in February. The sales revenue increased by almost 4% to AU$20.8 billion. The net profit of AU$616 million did beat the analysts’ forecasts and was 11.6% higher than the corresponding period in the previous year.

On the flip side, the company faced issues like higher labor costs, higher energy bills, and supply disruptions. The company further announced that it expects higher costs to continue, but volumes have started improving.

Post-results, analyst Lisa Deng from Goldman Sachs reiterated her Sell rating on the stock. Deng is optimistic about the shopping volumes but expects lower comp sales due to the company’s “value-focused-strategy.”

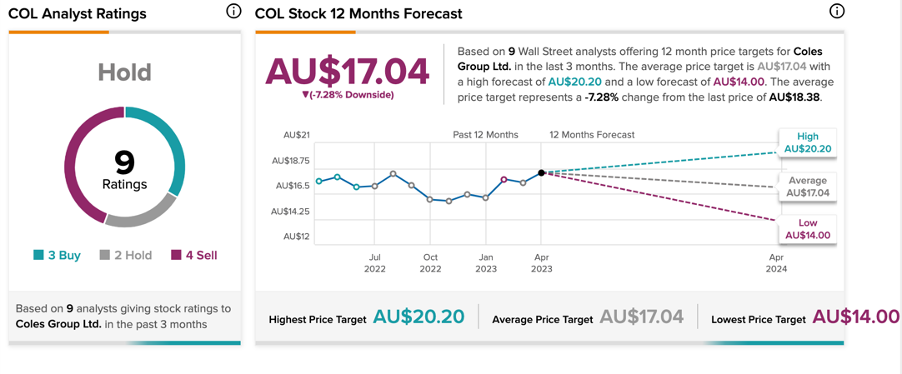

Coles Share Price Forecast

COL stock has a Hold rating on TipRanks, based on a total of 10 recommendations, of which four are Sell.

The average target price is AU$17.04, which is 7.28% lower than the current price level.

The shares have been trading up by almost 14% YTD.

Wesfarmers Limited

Wesfarmers is a conglomerate with a broad range of companies under its purview. The company’s operations include hardware, apparel, home décor, industrial products, etc.

Similar to Coles, Wesfarmers is also facing various challenges relating to inflation. The company is facing higher costs in labor, raw materials, supply chain, and more. Moving ahead, the company expects higher inflation to impact its demand, and higher costs are also expected to continue in the second half.

The company was still able to post a decent set of half-yearly results for the fiscal year 2023. The company’s revenue grew by 27% to AU$22.5 billion. The company also increased its interim dividend by 10% to AU$0.88 per share.

Recently, the Australian wealth management company Ord Minnett reiterated its Sell rating on the stock. They have predicted a 17% decline in prices from the current price for the next 12-month period. It also believes the company could face higher margin pressures for the next two years.

Is WES a Good Stock to Buy?

According to TipRanks, WES stock has a Moderate Buy rating, based on six Buy, two Hold, and four Sell recommendations.

The stock’s average price target of AU$48.46 shows a downside of 5.16% from the current levels.

Conclusion

These companies are well-known and big names in the Australian market. Analysts feel the companies are under inflationary pressure, and it’s not the right time for investment. The decline in share prices could create a better opportunity for investors to enter.

Both COL and WES have Hold ratings from analysts.