Chinese electric vehicle (EV) maker BYD Co. Limited (HK:1211) is planning additional share buybacks in a move to revive its share price momentum. The stock has declined 11% this year due to intense competition among EV manufacturers and concerns surrounding the Chinese economy. The company also outlined its plans to launch more luxury models this year, enhancing its brand value beyond affordable vehicles.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

These measures are a reaction to Beijing’s recent guidance, which urged public companies to bolster their investment appeal in light of the slump in the stock market.

The Road Ahead

In a recent exchange filing, BYD stated that it would develop a plan for share repurchases and execute these transactions in accordance with market conditions. The company did not disclose any amount for the planned repurchase.

According to an exchange filing in December 2023, BYD recommended a buyback of shares worth ¥200 million. The overall goal behind this move is to boost investor confidence and maintain stability in the firm’s value.

Furthermore, BYD plans to introduce more luxury vehicles this year and beyond to establish a prominent presence in the high-end market segment. It will commence local production in Thailand, Brazil, and Hungary, further expanding its global footprint.

Is BYD a Good Stock to Buy?

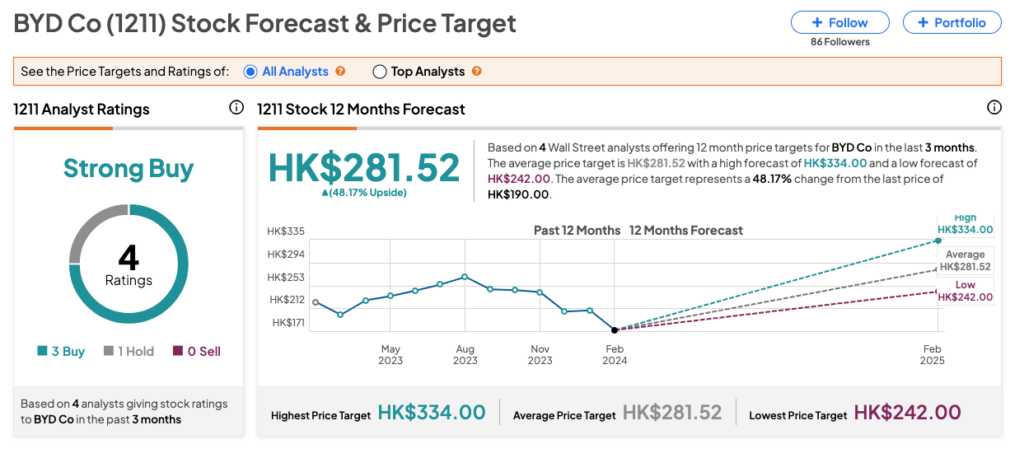

According to TipRanks, 1211 stock has received a Strong Buy consensus rating, backed by three Buys and one Hold recommendation. The BYD Co. share price target is HK$281.52, which implies an upside of 48.17% from the current trading level.