The SGX-listed BRC Asia Limited (SG:BEC) received a rating upgrade from UOB Kay Hian analyst Llelleythan Tan on Tuesday, indicating a bullish outlook for the stock based on the company’s growth prospects and attractive dividends. Tan and his team upgraded the rating for BRC Asia stock from Hold to Buy and raised the price target from S$1.73 to S$2.07.

BRC Asia manufactures steel reinforcing bars, weld fences, cages, and wire mesh.

The Bullish Case

Tan is highly bullish about the attractive dividend yield of around 10% offered by BRC stock. The company paid a total dividend of S$0.16 per share in FY23, reflecting a payout ratio of 58%. This also included a special dividend of 5.5 cents per share.

Even though BRC Asia does not have a formal dividend policy, Tan expects the company to maintain its historical average payout ratio of 60% in FY24, supported by its operating cash flows. As a result, the company’s dividend yield will be around 10% in FY24 as well. He also expects the company to gradually reduce its debt levels, further strengthening its dividend story.

Another feather in the cap is the company’s strong order book of S$1.3 billion at the end of FY23. BRC continues to experience a solid demand for its products due to upcoming housing and infrastructure projects, including big ones like Changi Airport Terminal 5 in Singapore.

In the full-year results for FY23, the company’s net profit declined by 16%, with revenue down 4% due to the temporary slowdown in the local construction industry. Moving forward, the company anticipates a sustained recovery and is well-prepared to meet the demands of its robust order book.

Is BRC Asia a Good Investment?

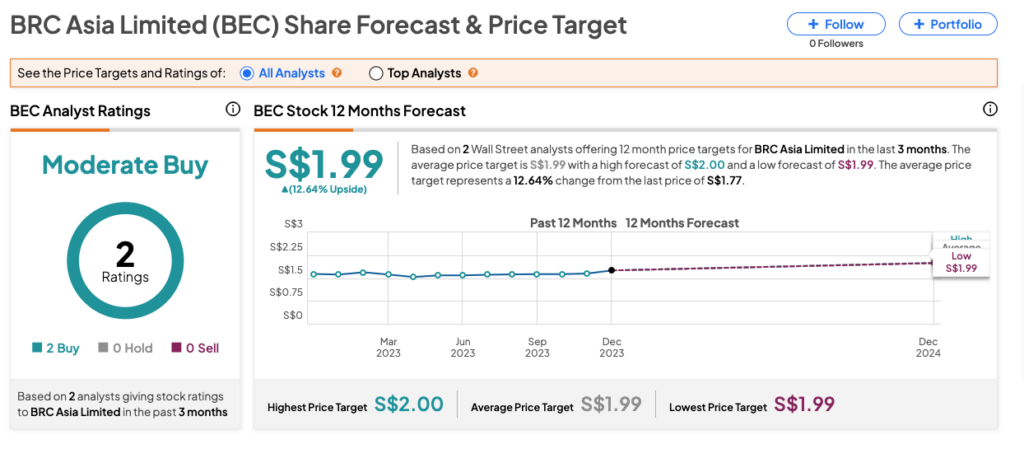

BEC stock has a Strong Buy consensus rating on TipRanks, backed by two Buys. The BRC Asia share price target is S$1.99, which is 12.64% higher than the current trading level.