FTSE 100 constituent BP PLC (GB:BP) today announced its half-yearly earnings, including second-quarter numbers for 2023. Despite a 70% decline in its earnings, the company raised its dividend along with additional share buybacks.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company’s shares have shown a positive response and have surged 1.4% so far today at the time of writing. Overall, the shares have remained volatile in 2023 and have only moved up by 3.3% YTD.

The Number Game

In the latest earnings report, the company posted underlying profits of $2.6 billion for the second quarter, marking a nearly 70% decline from the $8.5 billion recorded in the corresponding period last year. This figure also fell short of analysts’ expectations by nearly $1 billion.

The company’s profits were mainly impacted by lower fossil fuel prices, reflecting a trend seen throughout the energy industry. The decline in performance was also due to lower refining margins and planned maintenance work. Additionally, the previous few quarters witnessed higher earnings by the energy companies, which have now subsided.

The company’s profits were mainly impacted by lower fossil fuel prices, reflecting a trend seen throughout the energy industry. The decline in performance was also due to lower refining margins and planned maintenance work. Additionally, the previous few quarters witnessed higher earnings by the energy companies, which have now subsided.

Despite the lower figures, BP announced a dividend of $0.72 per share, showing a 10% increase over last year. It also pledged to carry out $1.5 billion in share repurchases during this quarter, adding to the $4.5 billion in share buybacks already announced and completed earlier this year.

Analyst Biraj Borkhataria from RBC Capital feels the company would have used the extra cash to pay off the debt and “delay the dividend increase to later in the year.” Borkhataria confirmed his Buy rating on the stock seven days ago.

2023 Outlook

For 2023, BP has revised its expectations, projecting higher reported and underlying upstream production compared to 2022. Specifically, BP foresees an increase in underlying production from oil production and operations and a slight decrease in production from gas and low-carbon energy.

In 2023, capital expenditures are projected to range from $16 billion to $18 billion. It maintains its plan to allocate 40% of surplus cash flow to support the balance sheet while also committing to utilizing 60% of the surplus cash flow for share buybacks.

Is BP a Good Share to Hold?

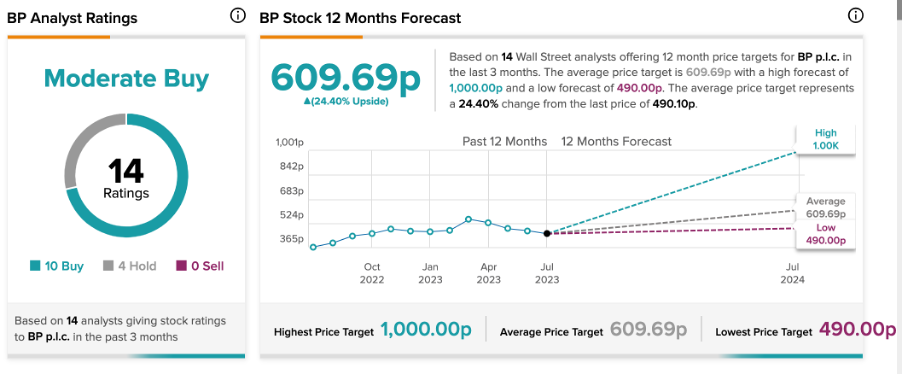

According to TipRanks’ analyst consensus, BP stock has a Moderate Buy rating. The stock has 10 Buy and four Hold recommendations.

The average share price forecast is 609.7p, which is almost 24.4% higher than the current price level.