Shares of BNP Paribas (FR:BNP) tanked 9.2% yesterday after the French lender missed sales and profit estimates for the fourth quarter. Net income in Q4 FY23 plunged 50% year-over-year to €1.07 billion due to charges of €645 million related to “risk on financial instruments.” Plus, Q4 sales were nearly flat year-over-year at €10.9 billion, missing analysts’ consensus of €11.44 billion.

BNP Paribas is Europe’s biggest bank by assets. It was formed by merging two big banks, namely Banque Nationale de Paris and Paribas, in 2000.

Details About BNP’s Performance

The bank blamed lawsuits related to Swiss franc mortgages in Poland and provisions on receivables for its weak performance in the quarter. Furthermore, BNP delayed the timeline for meeting its return on tangible equity (ROTE) target of 12% to 2026 from 2025. The bank also reduced its average annual net income growth target for 2022 to 2025 to nearly 8% from over 9%.

BNP’s Investment and Protection Services (IPS) division was the worst performer in the quarter, while real estate and consumer finance businesses continued to be weak owing to macro headwinds.

On a positive note, BNP Paribas said that it would increase its cash dividends by 18% to €4.60 per share annually and undertake a share buyback of €1.05 billion.

For the full year 2023, BNP’s revenue rose 3.3%, while Distributable Net Income grew 10.2%, in line with the company’s target.

Looking ahead, CEO Jean-Laurent Bonnafe cautioned that he does not expect the bank to perform exceptionally well in the short term due to a slowdown in the eurozone economy. The prolonged elevated interest rate environment has kept the bank’s net income and shareholder returns higher until now. Having said that, the possibility of interest rate cuts in the future could hurt banks.

Is BNP a Good Stock?

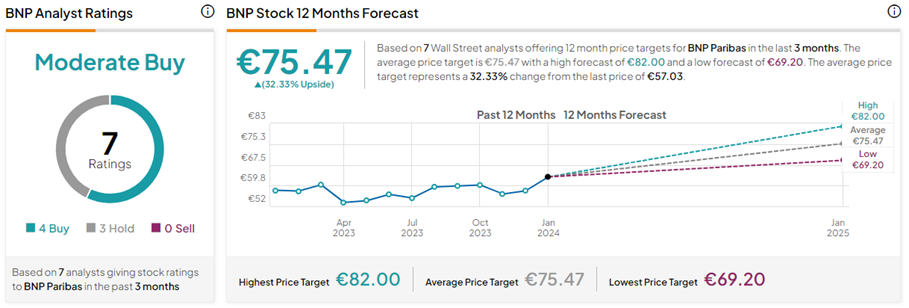

Following the Q4 print, three analysts reiterated a Buy rating on BNP shares. J.P. Morgan analyst Delphine Lee maintained a Hold rating on BNP shares with a price target of €71 (24.5% upside), calling the results “disappointing.”

Overall, with four Buys versus three Hold ratings, BNP stock has a Moderate Buy consensus rating on TipRanks. The BNP Paribas share price forecast of €75.47 implies 32.3% upside potential from current levels.