ASX-listed BHP Group Limited (AU:BHP) is a global mining company involved in the extraction and production of various commodities such as iron ore, coal, copper, nickel, and other minerals.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The stock has generated a return of 25.7% in the last year, driven by higher output and favorable commodity prices. However, falling mineral prices and higher inflation costs have hit the operations.

Even though analysts are bullish on the overall prospects, the future performance of BHP’s share price might be influenced by the outlook for iron ore prices. China, being the largest global importer of iron ore, holds significant influence over market sentiment, and the price of iron ore can be influenced by economic developments in China.

What Are Analysts Predicting?

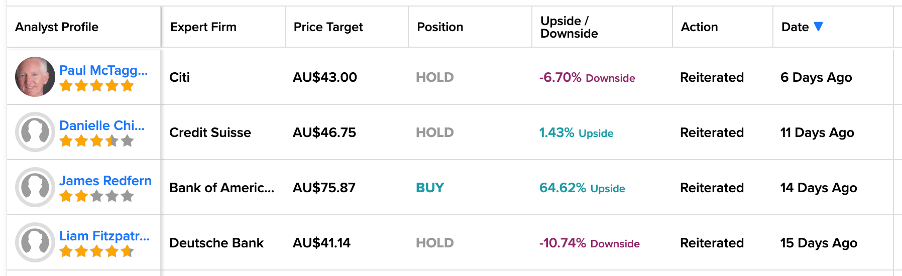

BHP’s stock enjoys wide coverage from analysts with mixed views on the share price.

Citigroup analyst Paul Mctaggart reiterated his Hold rating on the stock six days ago, with a downside prediction of 6.7%. Citigroup also predicts the iron ore price to go down to $90 by the end of this year, which could be challenging for the company.

James Redfern from Bank of America is highly bullish on the stock and confirmed his Buy rating 14 days ago. At a price target of AU$75.87, he predicts a huge upside of 64.6%.

Paul Young from Goldman Sachs believes that the company has a “major opportunity” to boost its copper production in South Australia. Last month, Young confirmed his Buy rating on the stock with a potential upside of 8% in the share price.

Is BHP Stock a Good Buy?

According to TipRanks, BHP stock has a Hold Buy rating based on a total of 16 recommendations, of which five are Buy.

The target price is AU$46.18, which is almost similar to the current trading levels.

Conclusion

According to analysts, BHP stock doesn’t have much upside to its share price, and its trajectory will largely depend on iron ore prices. Currently, the outlook for iron ore is characterized by volatility and frequent shifts, with changes occurring almost daily.

On the plus side, the diversified portfolio of metals, low production costs, and higher dividends act as tailwinds for the share price.