German companies Bayer AG (DE:BAYN) and Beiersdorf AG (DE:BEI) will announce their annual results for 2022 this week.

Analysts are impressed with Bayer’s previous results and are optimistic about the upcoming earnings as well. The stock also has a huge potential for growth in the future. Beiersdorf, on the other side, has mixed reviews on its stock despite higher forecasted revenues for 2022.

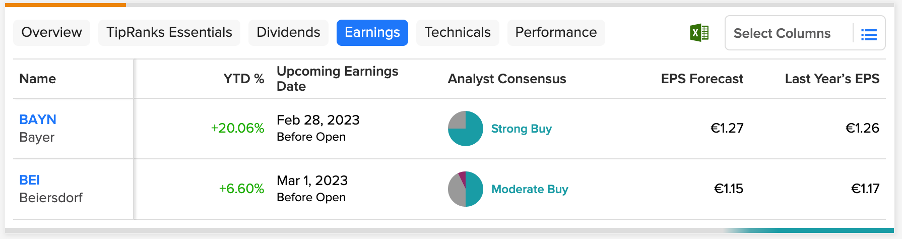

Here, we have used the TipRanks Earnings Calendar tool for the German market to pick these stocks with upcoming earnings. This tool guides investors with the latest information on the earnings dates of the companies, along with forecasted EPS and sales numbers.

Let’s have a look at these companies in detail.

Bayer AG

Bayer is among the world’s leading pharmaceutical and biotechnology companies. The company has three major product areas: pharmaceuticals, consumer health, and crop science.

The company’s stock has been off to a good start in 2023 and is trading up by 20% year-to-date. Investors and analysts have welcomed the new leadership change in the company with the appointment of its new CEO, Bill Anderson.

Bayer is scheduled to report its full-year results for 2022 on February 28. According to TipRanks, the consensus EPS forecast for Q4 is €1.27 per share, slightly up from €1.26 per share in the prior year’s quarter.

Analysts are highly bullish on the earnings after the company confirmed its full-year guidance numbers in the previous financial update. For 2022, the company expects its sales to be around €47 billion and an EBITDA margin of 26%-27% on a currency-adjusted basis. The company also expects a growth of 10% for its seed and crop protection segment, driven by higher prices. The full-year EPS is forecasted to be around €7.30 per share.

Is Bayer AG a Good Stock to Buy?

Ahead of its earnings, analysts remain highly bullish on the stock and have reiterated their Buy ratings. UBS analyst Michael Leuchten has the highest target price on the stock at €99.0, suggesting an upside of 67.3% from the current levels.

According to TipRanks’ rating consensus, BAYN stock has a Strong Buy rating.

The average price forecast for the stock is €75.92, which shows a change of 28.3% from the current price.

Beiersdorf AG

Beiersdorf is a German manufacturing company known for brands like Nivea, Eucerin, and Hansaplast. The business specializes in personal care and self-adhesive products.

The company will report its Q4 results and annual report for 2022 on March 1. The consensus EPS forecast is €1.15 per share for the fourth quarter, as compared to EPS of €1.17 per share in Q4 2021. The forecasted sales for this quarter are €2.09 billion. The sales for the first nine months of 2022 were €6.7 billion.

Considering its strong performance in the third quarter, Beiersdorf raised its full-year numbers. The company now expects higher sales for its consumer and tesa segments. Overall, group sales are expected to grow by 9%–10% in 2022.

Beiersdorf Stock Price Forecast

The stock has mixed opinions from analysts, with a majority of Buy ratings. On TipRanks, BEI stock has a Moderate Buy consensus rating, which includes seven Buy, six Hold, and one Sell recommendations.

The stock price forecast is €112.08, which is slightly lower than the current trading price.

Conclusion

Among these two companies, Bayer makes an attractive case for investment considering the upside potential in the stock. Analysts also remain bullish on the long-term prospects of the company, driven by its upcoming drug pipeline.

Meanwhile, analysts see limited growth in Beiersdorf stock at the moment as they await the company’s outlook for 2023 in the upcoming results.