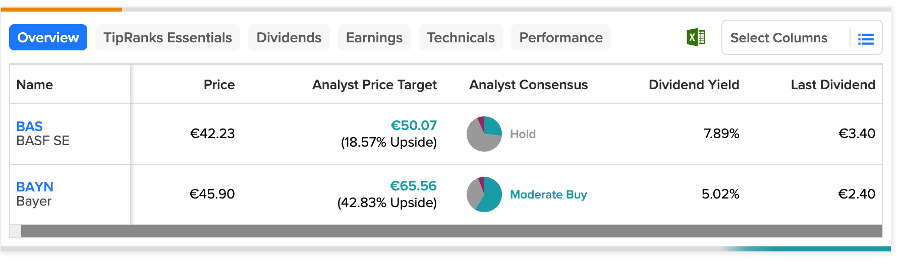

In today’s article, we have identified two German companies, BASF SE (DE:BAS) and Bayer AG (DE:BAYN), that are known for their dividend payments, offering stable income opportunities for investors. BASF offers an attractive dividend yield of 7.89%, while Bayer boasts a dividend yield of 5.02%.

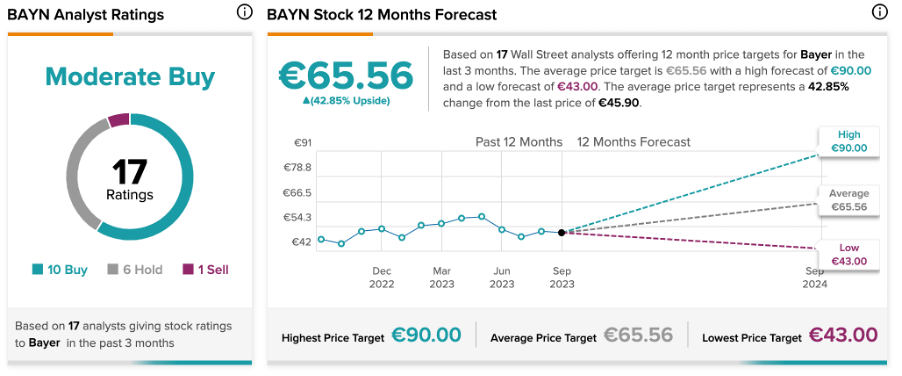

When it comes to potential capital appreciation, analysts have assigned a Moderate Buy rating to Bayer, forecasting a growth of over 40% in its share price. On the other hand, BASF stock has a Hold rating, with a more modest projected uptick of 18%.

TipRanks offers users an array of tools to help them choose dividend stocks that align with their specific preferences. In this case, we’ve used the Best German Dividend Stocks tool to refine our selection of these two companies, factoring in various additional considerations.

Let’s take a look at the two companies in detail.

BASF SE Dividend 2023

BASF is a prominent European manufacturing company that produces and distributes a wide range of products, including chemicals, plastics, crop protection items, and performance products.

BASF offers an appealing dividend yield of 7.89%, which stands out when compared to the sector’s average yield of 1.8%. The company is also included in the DivDAX share index, which is a selection of the 15 companies from the DAX 40 constituents with the highest dividend yields.

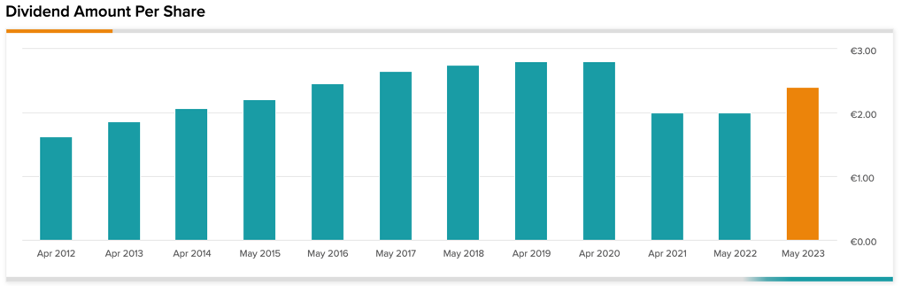

In recent years, BASF has demonstrated a consistent track record of maintaining and even enhancing its dividend payouts. In May 2023, BASF paid a dividend of €3.40 per share for Fiscal Year 2022, maintaining a dividend level similar to that of the previous year. The company’s dividends have steadily increased from €2.60 in 2012 to €3.40 in 2022, leading to an annual growth rate of 3%.

What is the Target Price of BASF Stock?

According to TipRanks’ analyst consensus, BAS stock has a Hold rating based on a total of 15 recommendations. This includes 10 Holds, four Buys, and one Sell rating. The BASF share price target is €50.07, which shows a growth of 18% from the current price level.

Bayer AG Dividend History

Bayer is a German biotechnology company involved in the research, development, and manufacturing of products within the fields of pharmaceuticals, consumer health, and crop science.

For the year 2022, the company paid a dividend of €2.40 per share in May 2023. This marked a 20% year-over-year increase, as compared to €2 paid for 2021. After maintaining stable dividends for the previous two years, the company paid higher dividends, aligning with its strong operational performance. The dividend payment corresponds to 30% of the 2022 core EPS, slightly down from 31% in 2021.

Looking ahead, the company’s strong financial performance is expected to continue, which should result in more dividend payments. The company’s crop science segment, which is responsible for half of its revenue, saw its operating profit nearly double in 2022, which is a positive indicator for the company’s future growth.

Is Bayer AG a Good Stock to Buy?

BAYN stock has received a Moderate Buy rating on TipRanks based on a total of 17 recommendations, of which 10 are Buy. It also includes six Holds and one Sell recommendation. The Bayer share price target of €65.50 is 43% higher than the current level.