Among the major UK stocks, defence giant BAE Systems PLC (GB:BA) has earned a Moderate Buy rating from analysts. However, the potential for share price growth appears constrained, given the expected slowdown in the company’s earnings growth. BAE Systems anticipates its underlying earnings per share (EPS) to increase between 6% and 8% in 2024, compared to the 14% growth experienced in 2023.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Nonetheless, the company maintains a positive outlook and anticipates opportunities for mid-term growth despite increasing competition in the market. This optimism is primarily fuelled by a strong outlook for government orders, particularly in the U.S., for its defence equipment amid rising geopolitical tensions.

BAE Systems is a British manufacturer and supplier of aerospace and defence products with a presence in around 40 countries. The company’s shares have surged by more than 120% since the onset of the Russia-Ukraine war in February 2022. Year-to-date, BA stock has gained around 18%.

Let’s dive into more details.

BAE Systems’ Robust Results and Promising Outlook

For the year ended on December 31, 2023, Bae Systems’ revenue grew by 9% to £23.08 billion compared to the previous year. The profit for the year increased to £1.94 billion, up from £1.67 billion reported in 2022. The highlight of the results was the company’s order intake, which climbed to £37.7 billion in 2023, up from £37.1 billion the prior year. Additionally, the order book surged by 19% to £58 billion as of December 31, 2023.

For 2024, the company expects its sales to grow by 10-12%, while underlying EBIT is projected to increase by 11-13%.

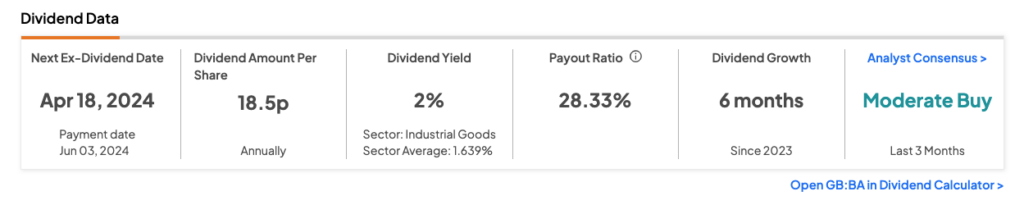

BA’s Stable Dividends

BAE Systems is known to be a reliable dividend payer on the FTSE 100 index. The company has a solid history of paying dividends for the last 25 years. The current dividend yield for BAE is 2%, higher than its industry average of 1.64%.

Following its robust performance in 2023, the company proposed a final dividend of 18.5p per share for 2023, resulting in a total dividend of 30p. This represents an 11% increase from the 27p dividend paid for 2022.

Is BAE a Good Stock to Buy?

Last month, analyst Charlotte Keyworth from Barclays assigned a Buy rating BAE Systems stock, predicting an upside of over 10%. At the same time, UBS analyst Ian Douglas confirmed his Buy rating on the stock with a similar growth forecast.

Overall, according to TipRanks consensus, BA stock has received a Moderate Buy rating based on four Buys, four Holds, and one Sell recommendation. The BAE share price target is 1,358.96p, which is 3.4% above the current trading levels.