In key news on Australian stocks, Worley Limited (AU:WOR) shares plummeted 8% as of writing, after the company confirmed that its key shareholder, Sidara, offloaded around 19% stake through an underwritten block trade. Year-to-date, WOR stock is down by almost 14%.

Worley Limited provides consulting and advisory services within the energy, chemicals, and resources sectors. Meanwhile, Sidara (formerly known as Dar Group) is a Dubai-based architecture and consulting company.

Details of the Sale of Sidara’s WOR Stake

After the recent sale, Sidara Group’s stake stands at 4.5%, down from 23.5%. Sidara initially acquired a stake in Worley in 2017 after a failed takeover approach in 2016. The sale amounts to AU$1.63 billion ($1.07 billion) based on Worley’s closing price of AU$16.3 on Monday, Reuters reported.

According to its exchange filings, Worley’s CEO, Chris Ashton, appreciated current shareholders and greeted prospective new shareholders who will be joining as a result of this block trade.

Is Worley a Good Stock to Buy?

Sidara’s sale of its stake in Worley doesn’t affect the company’s earnings and revenues, and hence, today’s drop could be seen as a buying opportunity by investors. Additionally, analysts remain bullish on Worley stock, driven by the company’s solid performance in the first half of FY24. The company achieved a 22% growth in its aggregated revenue of $5.6 billion in the first half compared to the prior corresponding period. Underlying EBITA increased by 28% to $345 million.

Earlier this month, Citi analyst James Byrne reiterated his Buy rating on WOR stock, predicting an upside of over 30%. Byrne is bullish on the company’s FY24 revenues and expects a potential 5% increase in FY24 consensus EBITA forecasts solely from revenue seasonality, before factoring in growth.

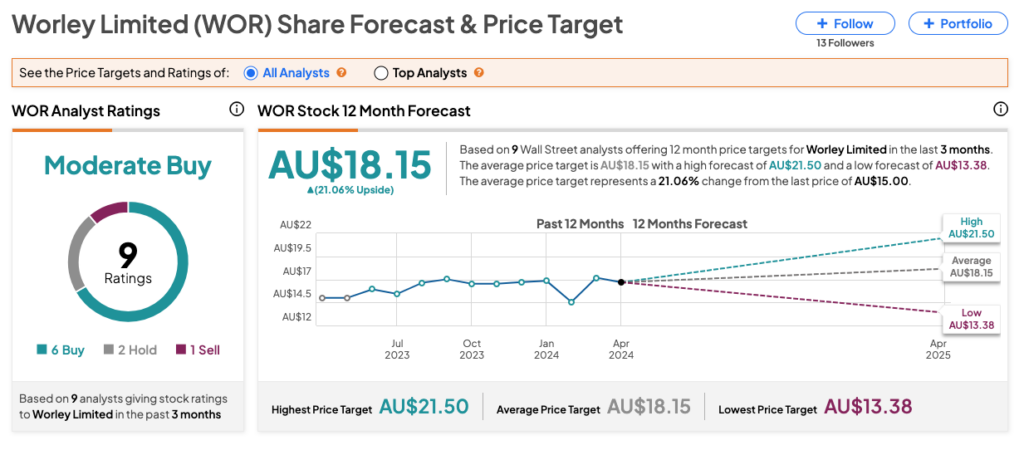

According to TipRanks’ rating consensus, WOR stock has a Moderate Buy rating, backed by nine recommendations. The Worley share price forecast is AU$18.15, indicating an upside of 21% from the current trading levels.