In major news on Australian stocks, Treasury Wine Estates Limited (AU:TWE) shares soared over 5%, as of writing, after the company maintained its FY24 guidance in the investor and analyst event. The company expects mid-to-high single-digit EBITS (earnings before interest, tax, material items, and self-generating and re-generating assets) growth for the full year, excluding the contribution from the DAOU Vineyards acquisition in the second half.

The company also expressed optimism regarding its prospects in North America and projects EBITS from Treasury Americas to be in the range of $223 million to $228 million in FY24.

TWE is a leading wine-making company with a portfolio of over 70 premium wine brands, catering to customers in around 70 countries.

Long-Term Growth Potential for Treasury Americas

During the event, Treasury Wine highlighted the growth potential of Treasury Americas’ luxury portfolio and the expected earnings increase from the DAOU Vineyards deal. In December 2023, the company completed the acquisition of DAOU Vineyards, which operates a leading luxury wine business in the U.S. This acquisition helped the company enhance its portfolio of premium brands in the U.S., solidifying its position as a global leader in luxury wine.

The acquisition also filled a significant gap in Treasury Americas’ portfolio for wines priced between $20 and $40 per bottle and bolstered its luxury portfolio for wines priced above $40 per bottle.

Moving forward, Treasury Wine Estates expects low double-digit NSR (net sales revenue) growth for DAOU over the medium term. DAOU EBITS is expected to be around $24 million, in sync with its expectations.

Additionally, the acquisition is anticipated to boost EPS (pre-synergies) and contribute to mid to high single-digit EPS growth in the first year of ownership.

What is the Stock Price Forecast for Treasury Wine?

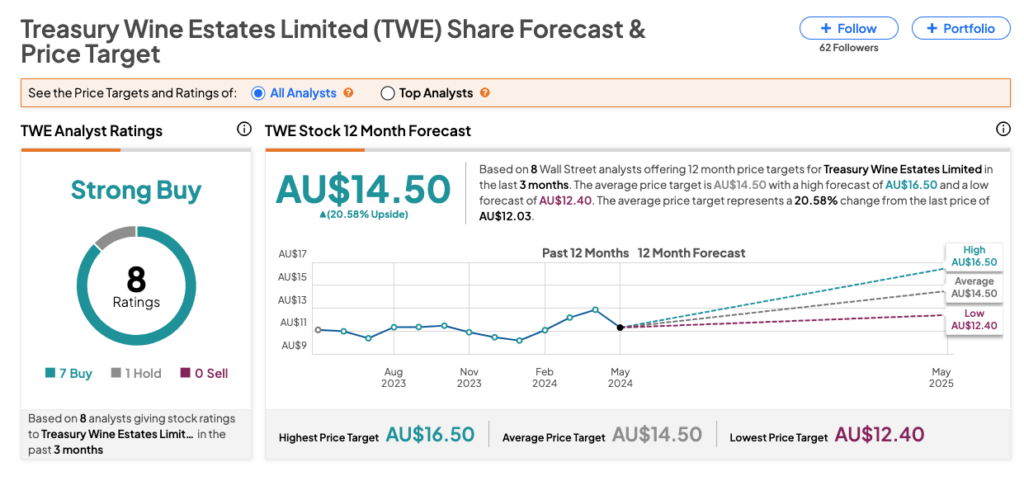

As per the consensus among analysts on TipRanks, TWE Stock has been assigned a Strong Buy rating based on seven Buys and one Hold recommendation. The Treasury Wine stock price forecast is AU$14.50, which is 20.5% above the current trading levels.