In top news on Australian stocks, Lifestyle Communities Ltd. (AU:LIC) shares fell sharply over 13% today after the company withdrew its forward-looking guidance. The withdrawal is mainly due to the challenges in quantifying how recent media coverage and the resulting uncertainty might affect future sales and settlements.

According to its previously stated guidance, the company expected to settle between 425 and 475 homes for FY25. Additionally, the target for new home settlements from FY24 to FY26 was between 1,400 to 1,700. However, this guidance has now been withdrawn.

Lifestyle Communities develop, own, and manage land lease communities that offer affordable housing solutions across Australia.

Lifestyle Communities Faces Allegations

Before the withdrawal of guidance, Lifestyle Communities shares faced pressure following media allegations over its exit fee policy. Although the company has denied these claims, the ongoing legal dispute has contributed to uncertainty and negative sentiment among investors.

Over the past five days, shares have declined by more than 16% and are currently trading at a four-year low.

Since February 2024, homeowners have been raising issues with the company and remain unsatisfied with the company’s responses. As a result, the homeowners have taken their concerns to the VCAT (Victorian Civil and Administrative Tribunal) to resolve the issue.

Lifestyle Communities FY24 Results Snapshot

Lifestyle Communities also announced its unaudited results for FY24. Despite a challenging trading environment, the company achieved sales of 376 new homes, marking its fourth-highest total.

On the other hand, the company’s operating profit after tax for FY24 is projected to be between AU$52.4 million and AU$53.4 million, down from AU$71.1 million in FY23. In FY24, the new home settlements were 311, down from 356 in the previous fiscal year. The company attributed this weak performance to elevated interest rates, high inflation, and ongoing insolvencies in the housing sector, all of which have weakened consumer confidence.

Is Lifestyle Communities Stock a Good Buy?

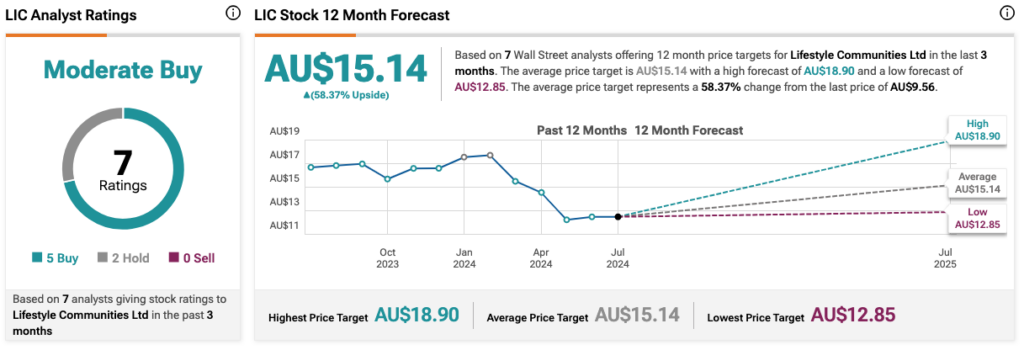

According to TipRanks consensus, LIC stock has received a Moderate Buy rating based on five Buy and two Hold recommendations. The Lifestyle Communities stock prediction is AU$15.14, which is 58.4% above the current price level.