Shares of ASX-listed Fortescue Metals Group Limited (AU:FMG) fell by 10.17% today after Capital Group reportedly sold an AU$1.9 billion stake in the company. According to Bloomberg, Capital Group sold the stake at AU$18.5 per share, marking a discount of almost 9% on Fortescue’s closing price on Monday. Capital Group completed the sale through J.P. Morgan Chase & Co. bankers.

The sale follows Fortescue’s recent announcement of its decision to scale back its goal of becoming a major player in green hydrogen. As part of this move, the company plans to reduce its global workforce by about 700 jobs and pause its ambitious 2030 hydrogen production goals. Analysts at Macquarie warned that the shift in Fortescue’s green energy strategy might diminish its share price premium compared to competitors.

Fortescue is a mining company focused on iron ore and green energy. Over the last five days, FMG stock has lost 13.4% in trading, triggered by its quarterly update and the stake sale news.

Fortescue’s June Quarter Update

Last week, Fortescue reported its quarterly update for the quarter that ended on June 30, delivering an expectational performance. It achieved record iron ore shipments of 53.7 Mt (million tonnes), marking a 10% year-over-year increase. For FY24, the total shipments reached 191.6 Mt. The performance also highlighted the efficiencies realized through the company’s recovery plan after the iron ore cars derailment in December 2023.

Looking forward, Fortescue aims to achieve shipments in the range of 190 Mt to 200 Mt in FY25.

Is Fortescue a Good Buy?

Despite the record numbers, Fortescue shares have experienced volatility. This is because the company is a commodity producer and is heavily influenced by fluctuations in commodity prices.

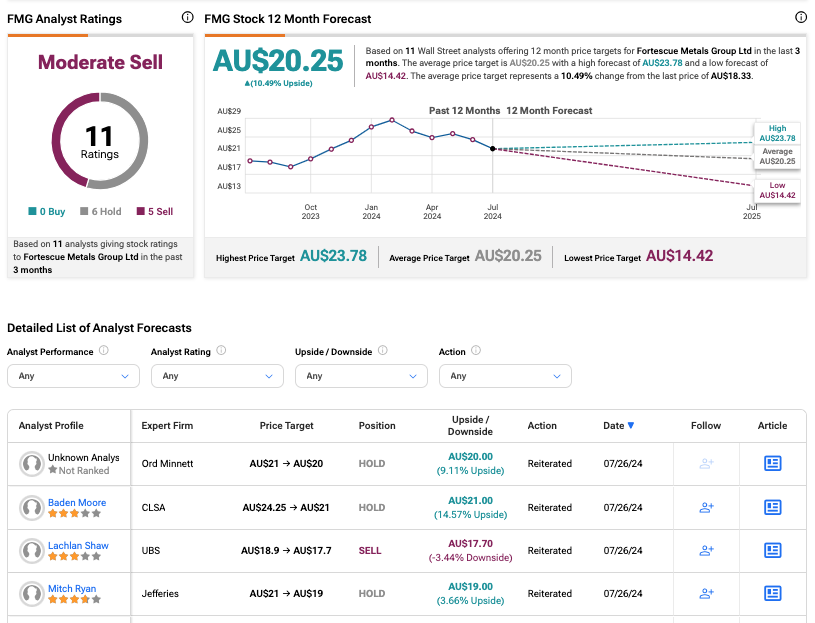

Analysts have a bearish outlook on FMG stock, as reflected in its Moderate Sell rating. According to TipRanks, the stock has received five Sell and six Hold recommendations. The average Fortescue share price target is AU$20.25, which is 10.5% above the current trading levels.