ASX-listed Tabcorp Holdings Limited (AU:TAH) posted a dip in its revenue in its first quarter update for the fiscal year 2024, sending its shares down to their lowest level in over two years. The stock declined by 6.15% today after the announcement. Year-to-date, the stock has experienced a decline of 15%.

The company stated that the weaker numbers depicted a “softer trading environment.” Moving forward, the company remains committed to the execution of its TAB25 strategy to make decisions that align with the long-term success of the business.

Tabcorp is a leading entertainment and gambling company in Australia. It provides wagering and gaming products and services in the country.

Q1 2024 Update

The company reported a 6.1% decline in revenues for the three months that ended on September 30, as compared to the same period a year ago. This decline included a 5.4% drop in wagering and media revenue and a 12.7% decrease in gaming services revenue, which offset slight growth in digital wagering.

Tabcorp attributed the 12.7% decline in gaming services revenue to the sale of eBet in February. The downfall in wagering and media revenue primarily reflected the unfavorable impact of racing and sports results.

The company will announce its second-quarter results for FY24 in February 2024.

Are Tabcorp Shares a Good Buy?

Eight days ago, brokerage house Ord Minnett upgraded its rating from Hold to Buy on the stock, predicting an almost 20% increase in the share price.

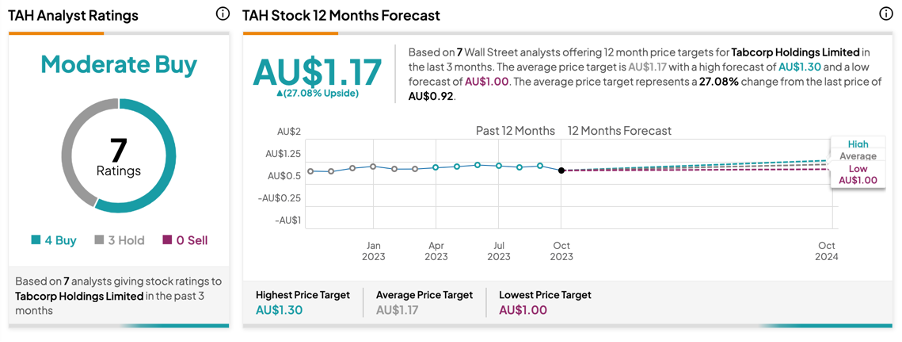

As per the consensus rating on TipRanks, TAH stock has received a Moderate Buy rating, supported by a total of seven recommendations. It includes four Buy and three Hold ratings. The Tabcorp share price forecast is AU$1.17, signifying a potential upside of 27% from the current level.

Anticipated changes in assigned ratings and price targets are likely to ensue following the unfavorable numbers reported in the update.