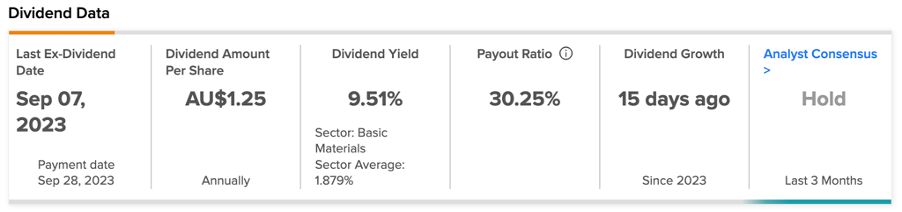

ASX-listed BHP Group Limited (AU:BHP) boasts a compelling dividend yield of 9.5%, providing a solid income opportunity to investors. The yield also surpasses the sector’s average of 2.12% by a huge margin. Notably, it holds the position among the top dividend-paying companies in Australia.

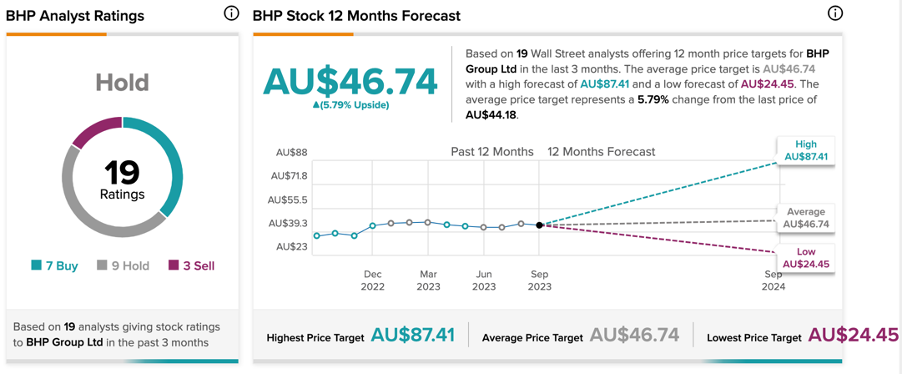

In terms of capital appreciation, analysts are not so bullish on the share price and have rated it as a Hold.

BHP is a global mining company that extracts and produces diverse commodities, including iron ore, coal, copper, etc.

Let’s dig deeper.

BHP Dividend 2023

For FY23, the company announced a final dividend distribution of $0.80 (AU$ 1.25) per share, totalling $4.1 billion. This dividend represents a 59% payout ratio and includes an extra allocation of US$0.64 billion beyond the minimum 50% payout policy. The dividend will be paid on September 28, 2023, to shareholders registered before September 7.

The total dividend for FY23 stands at $1.7 per share. This represents a decline of 48% from the payment made in FY22.

BHP Dividend Forecasts

The company reported slightly disappointing numbers in its annual results for FY23, but they were in line with market expectations due to lower commodity prices and higher costs. As a result, this has also put some pressure on the company’s future dividend payments. Nevertheless, they continue to present an enticing proposition for income-oriented investors.

Goldman Sachs has anticipated the total dividend for FY24 to be around $1.19 per share and $1.06 per share in FY25. 11 days ago, analyst Paul Young from Goldman Sachs reiterated his Buy rating on the stock, predicting a growth rate of 98%.

Is BHP Group a Good Stock to Buy?

According to TipRanks’ rating consensus, BHP stock has received a Hold rating, based on a total of 19 recommendations. The BHP share price target is AU$46.74, which is 6% above the current price level.

To find more such stocks in Australia, explore Best Australian Dividend Shares, an innovative tool that consolidates all top dividend-paying companies and compares them on different parameters.