ASX-listed BHP Group Limited (AU:BHP) profits declined by 37% in its 2023 earnings report following a period of lower prices, high inflationary costs, and China’s struggle to revive its growth. The company posted its lowest profit in the last three years but is still optimistic about China gaining its strength back, with developments already visible in a few sectors.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

BHP relies heavily on the construction industry in China for the demand for its steel derived from its iron ore. With China facing challenges to boost its property sector, miners like BHP have been facing wrath for the last two years.

The shares went down by over 1% yesterday after the results. However, they again gained almost 2% in today’s session. On the whole, the shares have experienced volatility in 2023, similar to the commodity prices it deals in.

BHP Group is a renowned mining company involved in the extraction and production of a wide range of commodities, including iron ore, coal, copper, nickel, and various other minerals. The company is headquartered in Australia and has operations in around 90 locations worldwide.

BHP Results 2023

The company posted underlying profits of $13.4 billion in 2023, which marked a 37% decrease from the profits of $21.3 billion reported last year. BHP’s revenue was down by 17% to $53.8 billion due to reduced prices of iron ore, copper, and coal. The attributable profit for the year decreased by 58% to $12.9 billion as compared to $30.9 billion posted in 2022.

BHP also decreased its full-year dividend by nearly half, reducing it to $1.70 from $3.25 in the previous year. This includes a final dividend of $0.80 per share, reflecting a payout of 59%.

Analysts’ Reactions

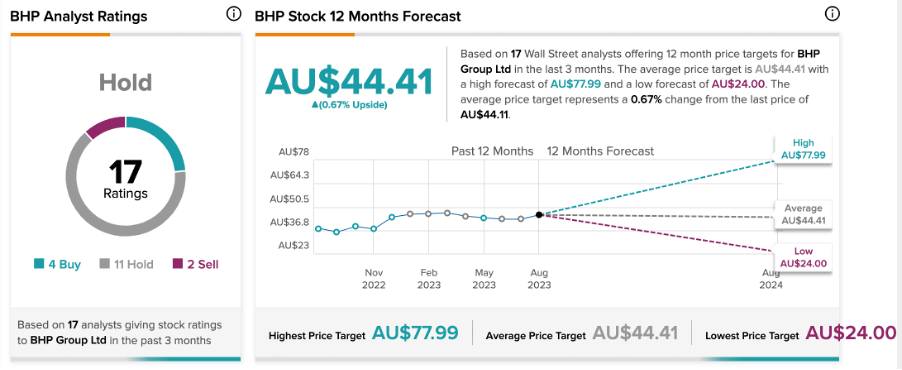

Post-announcement, many analysts have expressed their opinions on the numbers and confirmed their ratings accordingly. Overall, analysts have a cautious approach towards the share price growth as they believe the iron ore prices will continue to decline, impacting its profitability.

Among these analysts, James Redfern from Bank of America has the highest price target of AU$77.99, which implies an upside of more than 75% in the shares.

Analyst Tyler Broda from RBC Capital kept his Hold rating on the stock yesterday, forecasting a 30% growth in the share price. Broda stated that higher projections for capital expenditure and weak medium-term prospects for the Escondida copper mine “likely will weigh on the miner’s stock.”

Analysts at Jefferies believe that the major concern here is “the risk of a worsening deflationary downturn in the Chinese housing market.”

Is BHP a Good Share to Buy Now?

According to TipRanks, BHP stock has received a Hold rating backed by four Buy, 11 Hold, and two Sell recommendations. The average target price is AU$44.41, which is similar to the current trading level.