Shares of Anglo American (GB:AAL) are down over 9% as of writing after the mining company announced production and spending cuts. The company aims to significantly slash its mining output and reduce capital spending by $1.8 billion through 2026. Declining commodity prices, increasing costs, and operational challenges are dragging down AAL’s profits, compelling the British miner to streamline operations and reduce costs.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Anglo American is the world’s largest platinum producer. It also mines diamonds, copper, nickel, iron ore, and steelmaking coal. The miner plans to cut production by roughly 4% in 2024. Importantly, AAL will drastically cut the production of diamonds and platinum group metals while also lowering the production of copper and iron ore. The plans will affect Anglo American’s Chile and South Africa mining sites.

South Africa is facing issues with its power and logistics lines, impacting the production and delivery of minerals. Anglo American is yet to announce if production cuts will affect any jobs. Earlier in October, the FTSE 100-listed miner announced job cuts to save expenses worth $500 million. The company is now targeting an additional $500 million in savings in 2024. Year-to-date, AAL shares have lost 34.1%.

Is Anglo American a Good Stock to Buy?

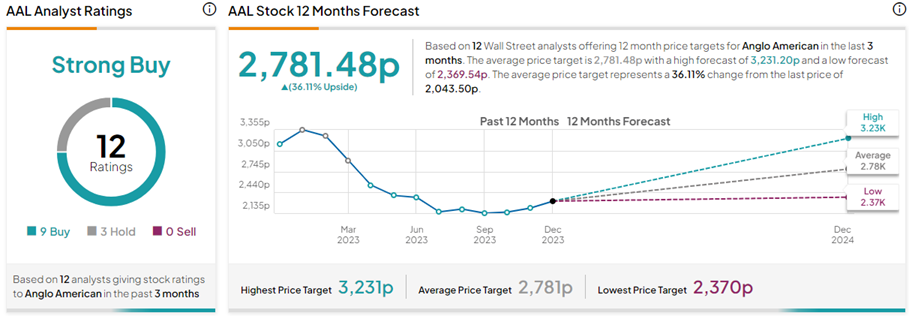

Following the news, two five-star analysts raised the price target on AAL stock.

Morgan Stanley analyst Alain Gabriel raised the price target to 2,370p (15.2% upside) and kept his Hold rating. Likewise, Citi analyst Ephrem Ravi lifted the price target to 3,000p (45.8% upside) and maintained his Buy rating on AAL stock.

Overall, with nine Buys and three Hold ratings, AAL stock has a Strong Buy consensus rating on TipRanks. The Anglo American share price forecast of 2,781.48p implies 36.1% upside potential from current levels.