As we are all set to enter 2023, overall economic conditions suggest the bear run will continue for some time. The analysts still remain bullish on some stocks, calling them the real winners. Analysts, as experts in their fields, can help investors make better stock selection decisions.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Based on this backdrop, we have used the TipRanks Trending Stocks tool for the Spanish market to pick two stocks. This tool covers the stocks that have been under the radar of analysts in the last few days.

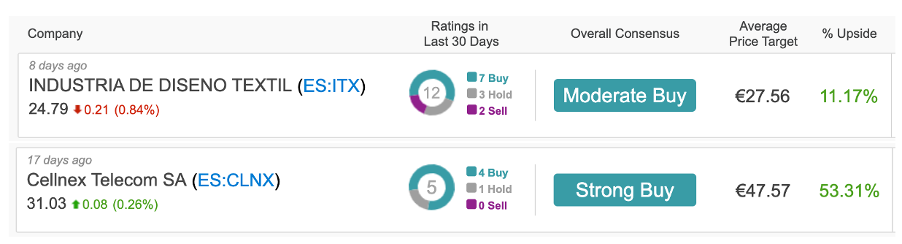

Both Industria de Diseño Textil, S.A. (ES:ITX) and Cellnex Telecom, S.A. (ES:CLNX) have received Buy ratings from the analysts. Analysts have reiterated and initiated Buy ratings on these stocks in the last few days.

Let’s see what makes these stocks the analysts’ favorites.

Industria de Diseño Textil, S.A (Inditex)

Inditex, a global name in fashion clothing for women, has brands like Zara, Massimo Dutti, Pull&Bear, Bershka, etc. under its umbrella.

The company’s share price has gained much-needed momentum and has been trading up by 16% in the last six months. The company’s performance in its half-yearly and quarterly results has been commendable, which has aided share price movements.

Analysts feel the two factors that have worked in favor of the company are increasing inventories and price hikes. The company was cautious about supply chain issues, especially during the winter season. To combat this, it increased production and stocked up on more inventory.

To cope with the rising raw material costs and offset any slowdown in clothing demand, Inditex increased its prices by 5% or more across some segments. The company also started charging for online returns, which helped it maintain its profitability. The gross margins were at 58.7% in the first nine months of 2022. The net income grew by 24% to €3.1 billion during the same period.

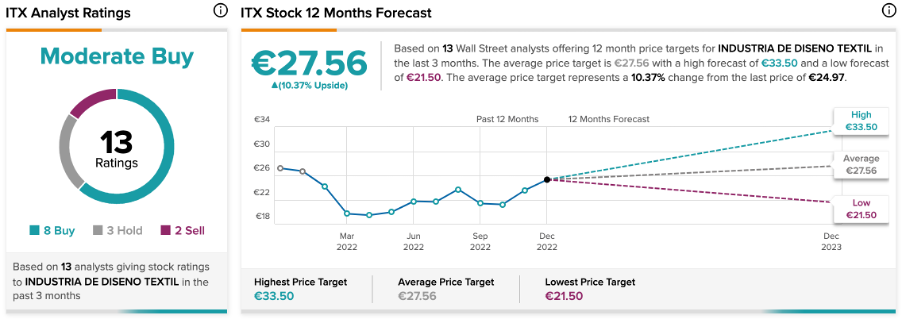

Inditex Stock Price Forecast

According to TipRanks’ analyst consensus, Inditex stock has a Moderate Buy rating based on a total of 13 recommendations.

The average price target is €27.56, which is 10.4% higher than the current price. The stock price has a high forecast of €33.5 and a low forecast of €21.5.

Cellnex Telecom SA

Based in Spain, Cellnex offers a wide range of telecommunication services across Europe.

As compared to Inditex, analysts are more bullish on Cellnex Stock, considering its past earnings growth. In the last five years, the company has seen a revenue growth of 31% per year. This depicts the company’s continued progress, which was also visible in its recent results.

For the first nine months of 2022, revenues were at €2.5 billion, which was 46% higher than the same corresponding period in 2021. EBITDA was also 45% higher in this period at €1.9 billion.

Apart from the earnings, analysts are also bullish on the company’s financial health. Cellnex anticipates generating positive free cash flow after 2024 and paying off its debts by 2027. The company’s leases are expected to generate €90 million to €100 million in savings by 2025.

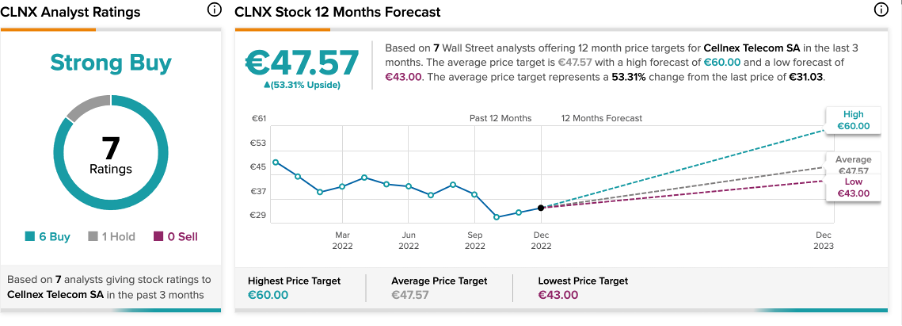

Is Cellnex a Buy?

According to TipRanks’ analyst consensus, Cellnex stock has a Strong Buy rating. The rating is based on six Buy and one Hold recommendations.

The average price target is €47.57, with an upside potential of 53%.

Luigi Minerva from HSBC has recently initiated coverage on Cellnex’s shares at a target price of €45, which is 45% higher than the current price level.

Conclusion

Following the analysts’ ratings and trusting their gut is one of the safest ways to make an investment decision. Inditex and Cellnex, both of which have stable earnings growth and Buy ratings from analysts, fit the bill.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.