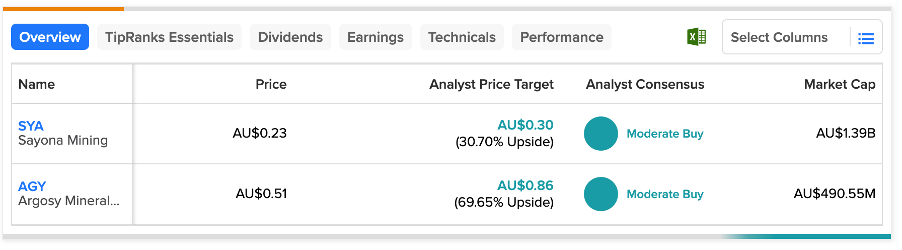

ASX-listed companies Sayona Mining (AU:SYA) and Argosy Minerals Limited (AU:AGY) are popular lithium mining stocks in Australia. Both stocks have garnered Buy ratings from analysts and are projecting substantial upside potential in their share prices.

Let’s have a closer look at these companies.

Sayona Mining Limited

Sayona Mining Limited is engaged in lithium production and operates projects in Quebec, Canada, and Western Australia.

YTD, the company’s stock has soared by 21%, having fallen by 2.13% over the last year. Moving forward, analysts are bullish on the stock and believe its geographical diversification and higher lithium prices will further support growth.

Analysts feel Sayona is appealing due to its ownership of multiple mining interests in both North America and Australia, two regions known for robust regulatory protection. Investors seeking to expand their risk profile might find the geographical diversification of Sayona Mining to be a significant advantage.

17 days ago, Reg Spencer from Canaccord Genuity re-rated the stock as Buy and predicted an upside of 35% in the share price.

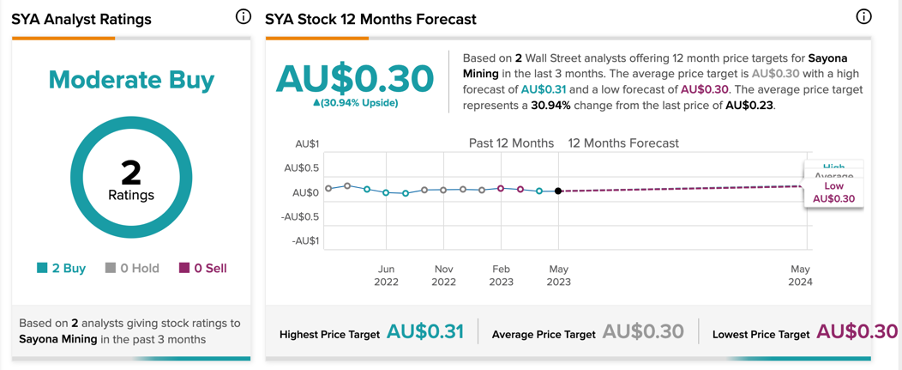

Sayona Mining Stock Price Prediction

Based on two Buy recommendations, SYA stock has a Moderate Buy rating on TipRanks. The average target price is AU$0.30, which shows a growth of 31% from the current price level.

Argosy Minerals Limited

Argosy Minerals Limited is a mineral exploration company with a primary focus on the exploration and production of various minerals, including lithium, copper, gold, graphite, and more.

Contrary to Sayona, Argosy’s stock has been on a downward journey and has lost almost 30% in the last three months. However, analysts are bullish on the company’s upcoming production numbers and are expecting a huge upside in the share price. The company’s Rincon Lithium project in Argentina will start production this year and is targeting achieving consistent run-rate production in the upcoming months.

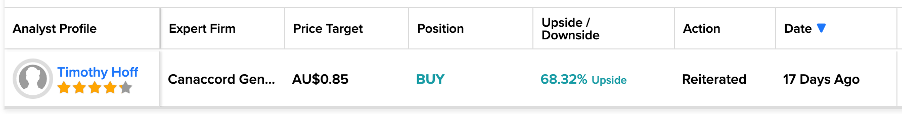

17 days ago, Timothy Hoff from Canaccord Genuity reaffirmed his Buy rating on the stock, projecting a substantial growth of 68% in the share price from its current level.

Argosy Minerals Stock Prediction

According to TipRanks, AGY stock has a Moderate Buy rating based on one Buy recommendation from Hoff. The average price target is AU$0.84, which is 8.74% higher than the current price.

Conclusion

Despite a significant cooling off of lithium prices in the last six months, multiple experts predict that the mineral will experience high demand for years to come. SYA and AGY are well-positioned to capitalize on the increasing prices, particularly with the growth of the electric vehicle (EV) revolution further widening the demand gap.