Glenview Capital, a significant shareholder in CVS Health (CVS), is expected to meet with the company’s leadership on Monday, according to an exclusive Wall Street Journal report. Apparently, the hedge fund has built up a sizeable stake in CVS and is aiming to present potential solutions for the healthcare company’s struggling business, according to the report. This meeting could potentially mark the beginning of an activist campaign by the hedge fund.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Glenview Has Built Up a Large Position in CVS

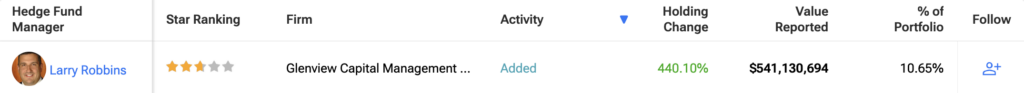

The WSJ report stated that Larry Robbins, founder of Glenview, has built up a large stake in CVS, which comprises around $700 million of the $2.5 billion hedge fund—roughly 28%. Currently, Glenview owns approximately 1% of CVS’s outstanding shares.

CVS Is Struggling with Financial Challenges

This meeting between Glenview Capital and CVS comes at a time when the company is struggling with rising financial challenges. The company has slashed its full-year guidance for the past three straight quarters. Moreover, the company’s profits are getting hammered by rising medical costs in its insurance segment, Aetna. In fact, this is an issue that is also affecting the broader healthcare industry.

The higher medical costs are linked to an increase in medical procedures done by senior citizens that were postponed during the COVID-19 pandemic. CVS’s health insurance service, Aetna, provides a range of insurance plans, including those for the Affordable Care Act, Medicare Advantage, Medicaid, as well as dental and vision services.

CVS Moves to Tackle Financial Struggles

In order to respond to these challenges, CVS announced a leadership shakeup earlier this year, with CEO Karen Lynch stepping in to take the reins of its insurance unit, effective immediately, and replacing the president of that segment, Brian Kane. Additionally, CVS announced a new plan to cut $2 billion in expenses over the next few years. This cost-reduction strategy includes streamlining operations and using artificial intelligence to improve efficiency. Moreover, the company is nearing the completion of a three-year plan to close 900 stores, having already closed 851 locations as of August.

CVS Responds to the WSJ Report

In its response, a CVS spokesperson stated that the company “maintains a regular dialogue with the investment community as part of our robust shareholder and analyst engagement program.” However, the spokesperson declined to comment on any specific engagements with individual firms or stakeholders.

Is CVS a Good Stock to Buy Right Now?

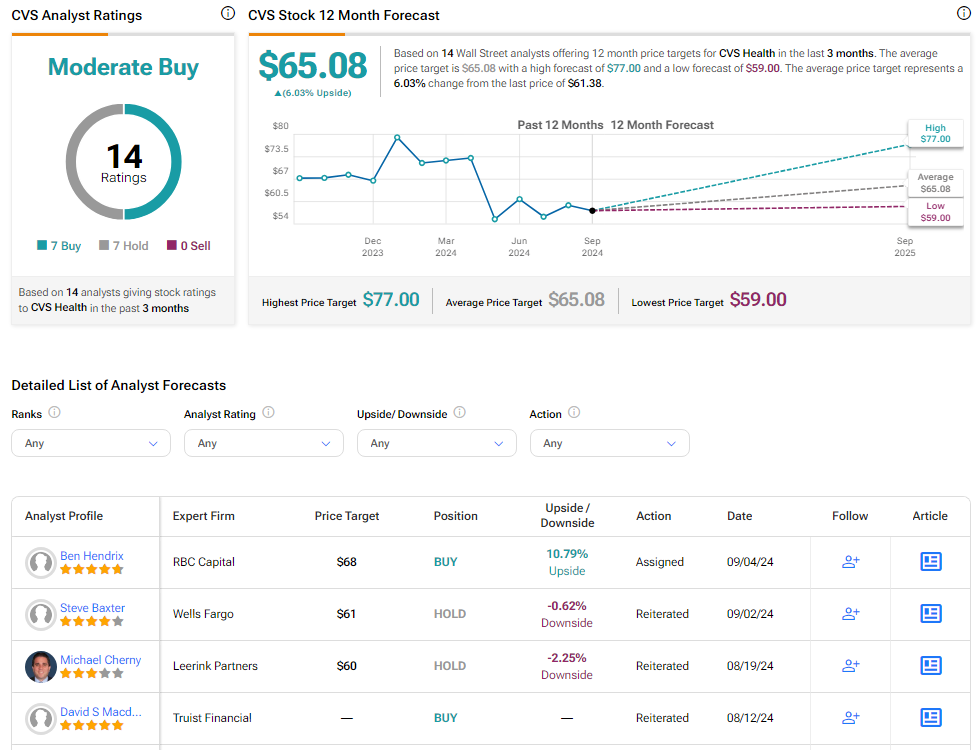

Analysts remain cautiously optimistic about CVS stock, with a Moderate Buy consensus rating based on seven Buys and seven Holds each. Year-to-date, CVS has declined by more than 15%, and the average CVS price target of $65.08 implies an upside potential of 6% from current levels.