Ginkgo Bioworks (DNA) stock is continuing its winning streak today with a 12% jump halfway through Tuesday’s trading. This is on top of an 11% price gain in the past five days. The price explosion comes after the company raised its revenue guidance. Moreover, second-quarter revenue jumped a whopping 231.4% year-over-year to $144.62 million, outperforming estimates by roughly $67 million. However, DNA stock’s net loss per share of -$0.41 came in lower than estimates of -$0.04.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Ginkgo, a horizontal platform for cell programming, is seeing a multitude of positives. It added 13 new cell programs during the quarter, which is an increase of 86% over the prior year. Additionally, the pending acquisitions of Zymergen for $300 million, along with Bayer’s agricultural biologicals R&D facility for $83 million, promise higher growth in the coming periods.

The company continues to deliver across cell programming and its biosecurity vertical. Its foundry revenue clocked an impressive 105% year-over-year growth during Q2.

The Co-founder and CEO of Ginkgo, Jason Kelly, remarked, “We executed well on our biosecurity business through the remainder of the school year and are seeing traction across this business with longer-term, diversified biosecurity opportunities, including being awarded a new contract from the CDC to continue our pathogen monitoring work in airports.”

Kelly added, “We are excited about our recently announced transactions with Zymergen and Bayer, which we expect to significantly improve our platform and drive future value.”

While its net loss per share widened, the company saw an improvement on an adjusted EBITDA basis, which narrowed to a loss of $23 million from a loss of $38 million a year ago. Nonetheless, a cash balance of $1.4 billion puts the company on a strong financial footing for the future.

Importantly, the company now expects to add 60 new cell programs for 2022 and expects to garner revenue between $425 million and $440 million. It had initially expected to generate total revenue between $375 million and $390 million for 2022.

Furthermore, Ginkgo and XpresSpa Group (XSPA) received a $16 million contract for the traveler-based SARS-CoV-2 genomic surveillance program of the CDC (Centers for Disease Control and Prevention). This expanded program will act as an early warning system to detect SARS-CoV-2 variants and can potentially exceed $61 million based on public health priorities.

Is Ginkgo Stock a Good Buy?

The Street has a Moderate Buy consensus rating on DNA stock with an average price target of $6.09, which implies 53% potential upside. Raymond James’ Rahul Sarugaser is even more optimistic about Ginkgo stock with a Buy rating and even upped his price target to $14.50 from $11.50. Sarugaser sees the addition of 13 programs as an important achievement and believes the company is on track to achieve 60 new programs for the year.

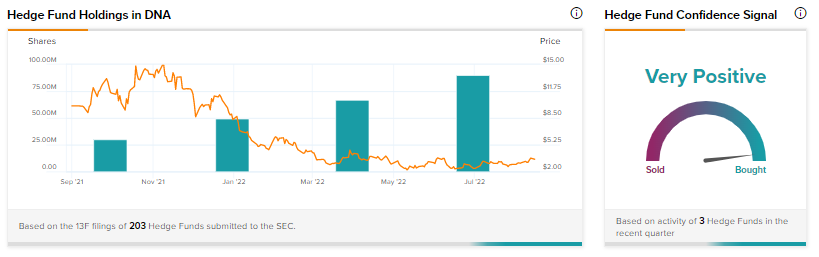

To add to this string of positives, hedge funds are also buying up Ginkgo hand over fist. Hedge funds have increased their Ginkgo holdings by 23.2 million shares in the last quarter, equating to a very positive confidence signal.

Furthermore, two of the biggest names on the Street, Ray Dalio’s Bridgewater Associates and Cathy Wood’s ARK Investment, have a holding in Ginkgo. While Bridgewater is a new entrant, ARK has increased its holdings by 35.37%.

Final Thoughts – DNA Stock Might Reward Investors

A beta of 2.11 indicates Ginkgo shares can be volatile. Nevertheless, DNA has an 8 out of 10 TipRanks Smart Score, which means that it is likely to outperform the broader market. In addition, if the company can sustain high revenue growth, then it will likely attract more institutional investors. As a result, this may lead to an increase in the share price.