Gilead Sciences Inc. (GILD) said that its biotech subsidiary Kite has received accelerated approval by the U.S. Food and Drug Administration (FDA) for the use of Tecartus as a treatment in adult patients with relapsed or refractory mantle cell lymphoma (MCL).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Tecartus, which is a chimeric antigen receptor (CAR) T cell therapy, will be produced in Kite’s commercial manufacturing facility in California. MCL is a rare form of lymphoma that arises from cells originating in the “mantle zone” of the lymph node and predominantly affects men over the age of 60. MCL is highly aggressive following relapse, with many patients progressing following therapy.

“Kite is committed to bringing the promise of CAR T therapy to patients with hematological cancers, and as such, we are proud to launch our second cell therapy,” said Kite CEO Christi Shaw. “We look forward to partnering with the lymphoma community to deliver this potentially transformative therapy to patients with relapsed or refractory MCL.”

The approval of the one-time therapy follows a priority review and FDA Breakthrough Therapy Designation and is based on results of an open-label study in which 87% of patients responded to a single infusion of Tecartus, including 62% of patients showing a complete response (CR). Among patients evaluated for safety, 18% experienced grade 3 or higher cytokine release syndrome (CRS) and 37% experienced grade 3 or higher neurologic toxicities.

Five-star analyst Evan Seigerman at Credit Suisse on July 24 upgraded Gilead to Hold from Sell with a $75 price target based mainly on the potential opportunity and contribution of remdesivir – the company’s experimental antiviral for the treatment of Covid-19 – on earnings this year. The analyst expects remdesivir will help the revenue trajectory in 2H.

“While the company will have at least 2M treatment courses by year-end – we do not expect $6B in incremental revenue (a portion was donated at no cost and other supply was used in trials),” Seigerman wrote in a note to investors. “We forecast a modest $1.9B, increasing to $5B in 2021 (treatment + stockpiling, even with other therapeutics expected and the potential for vaccines by 2021).”

Seigerman expects Gilead at its 2Q results, which are scheduled to be released on July 30, to update guidance to include revenues from remdesivir.

“We could see an uptick in R&D numbers for 2Q given the investment in remdesivir (even ahead of projected revenues in 3Q/4Q),” Seigerman added. “We’re not changing our numbers ahead of the quarter, but rather highlighting potential areas of softness heading into the print.”

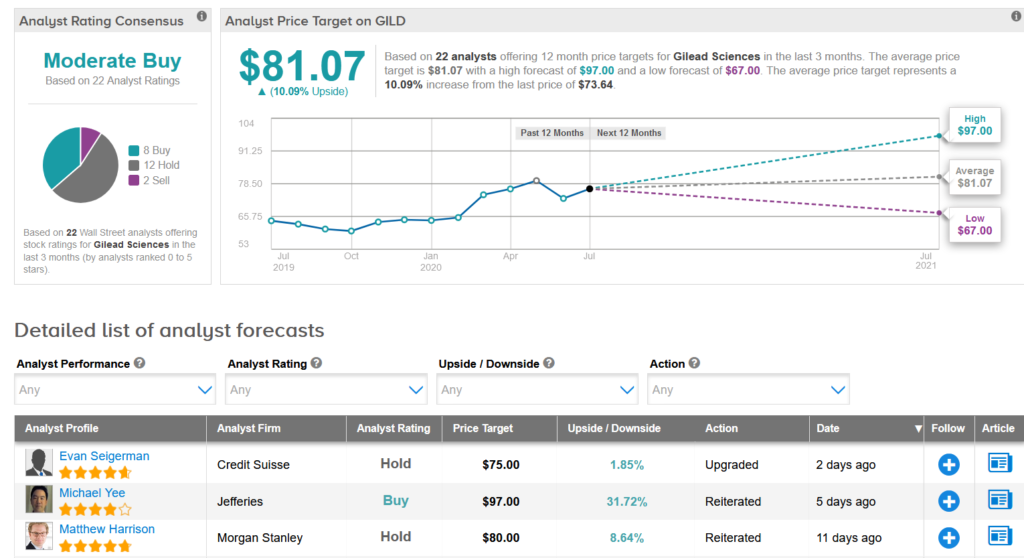

The rest of the Street is cautiously optimistic on the stock with a Moderate Buy consensus based on 8 Buy ratings, 12 Holds and 2 Sells.

Shares in Gilead dropped 2.5% to $73.64 at the close of trading on July 24 trimming the year-to-date advance to about 13%. The $81.07 average price target implies 10% upside potential in the shares in the coming 12 months. (See Gilead stock analysis on TipRanks).

Related News:

Gilead Pours $300M Into Tizona’s Cancer Immunotherapy Pipeline

NuVasive Spikes 5% After-Hours On Sharp Procedure Rebound

Acadia Plunges 12% As Depressive Study Misses Goals; Analyst Says Buy