Gilead Sciences’ Trodelvy (sacituzumab govitecan-hziy) has been granted accelerated approval by the US Food and Drug Administration (FDA) for use in the treatment of adult patients who have metastatic or locally advanced urothelial cancer (UC) and have received prior therapies. Urothelial cancer is a type of cancer of the bladder.

Gilead Sciences’ (GILD) Chief Medical Officer, Merdad Parsey, MD, PhD said, “Today’s accelerated approval is thanks to the patients and healthcare professionals involved in the TROPHY study, and we appreciate their partnership. This achievement, coupled with last week’s full FDA approval in unresectable locally advanced or metastatic triple-negative breast cancer, underscores our commitment toward rapidly delivering Trodelvy to patients facing some of the most difficult-to-treat cancers.”

FDA’s accelerated approval is based on the international Phase 2, single-arm TROPHY study. In this study, out of 112 patients, 27.7% of patients treated with Trodelvy responded to treatment with 5.4% of patients responding completely while 22.3% of patients experienced a partial response to the drug.

Gilead also said that continued approval for Trodelvy depends upon the clinical benefit of the drug in a confirmatory trial. The company said that a Phase-3 randomized confirmatory clinical trial TROPiCS-04 was underway on a global basis for Trodelvy. (See Gilead Sciences stock analysis on TipRanks)

Earlier this month, Bernstein analyst Aaron Gal upgraded the stock from Neutral to Buy with an $80 price target. Gal said in a research note to investors that the analyst expected that Trodelvy and magrolimab would give positive results in the treatment of both breast cancer and acute myeloid leukemia, respectively, in the second half of this year.

Gal also expects that the launching of the two drugs could result in 6.5% sales growth for GILD through 2024, resulting in increasing GILD’s growth valuation metrics in the range of $75 to $85 per share.

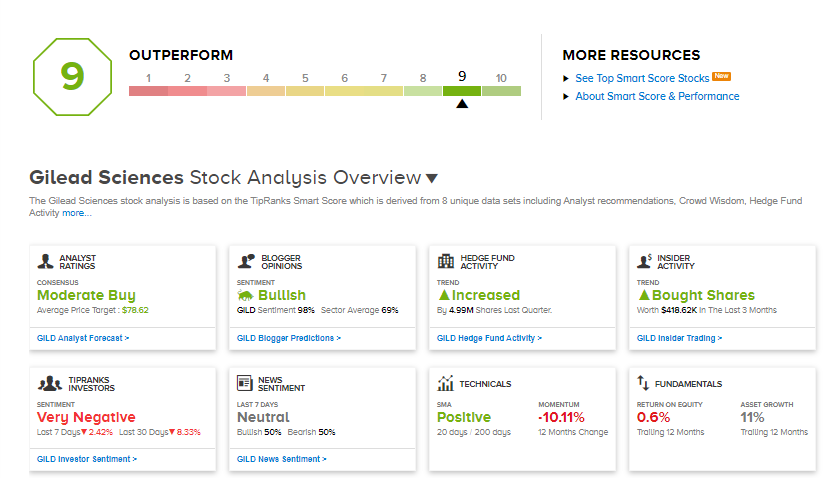

Wall Street currently rates GILD as a Moderate Buy based on 11 Buys, 5 Holds and 1 Sell. An average analyst price target of $78.62 implies 21.2% upside potential from current levels.

According to the TipRanks Smart Score system, GILD scores a 9 out of 10 indicating that the stock is highly likely to outperform the market.

Related News:

SAP Posts Fastest Cloud Business Growth In Five Years During 1Q, Raises Outlook

Public Storage Snaps Up ezStorage For $1.8B

Nvidia Gives Key Investor Day Updates; 1Q Revenue Tracking Above $5.3B 1Q Outlook

Questions or Comments about the article? Write to editor@tipranks.com