George Weston (WN), Loblaw’s parent company, reported a lower profit in the third quarter compared to a year earlier.

The lower profit is due to the sale of Weston Foods business. (See Analysts’ Top Stocks on TipRanks)

Revenue & Earnings

George Weston’s revenue for Q3 2021 came in at C$16.19 billion, an increase of 2.4% from the revenue of C$15.81 billion reported in Q3 2020.

The company reported a profit attributable to common shareholders of C$124 million (C$0.82 per diluted share) for the quarter ended October 9, down from a profit of C$303 million (C$1.96 per diluted share) in Q3 2020.

On an adjusted basis, George Weston earned C$359 million (C$2.39 per diluted share) for the quarter, compared to adjusted earnings of C$358 million (C$2.32 per diluted share) a year ago.

CEO Commentary

George Weston chairman and CEO Galen G. Weston said, “George Weston’s third quarter results reflect the strength of its underlying operating businesses. Loblaw’s focus on core retail execution and an enthusiastic consumer response drove another quarter of strong financial results, while Choice Properties’ results were stable and reflect its resilient necessity-based portfolio.

“With the recently announced agreements to sell Weston Foods, George Weston will continue to focus on its market-leading Retail and Real Estate businesses. The Company is pleased that the proud legacy of the bakery business is well-positioned to continue into the future with two high-quality buyers.”

Outlook

For 2021, George Weston expects adjusted net earnings from continuing operations to increase due to the results of its operating segments, including the continuous improvement in Loblaw’s performance, and to utilize the excess cash to buy back shares.

Wall Street’s Take

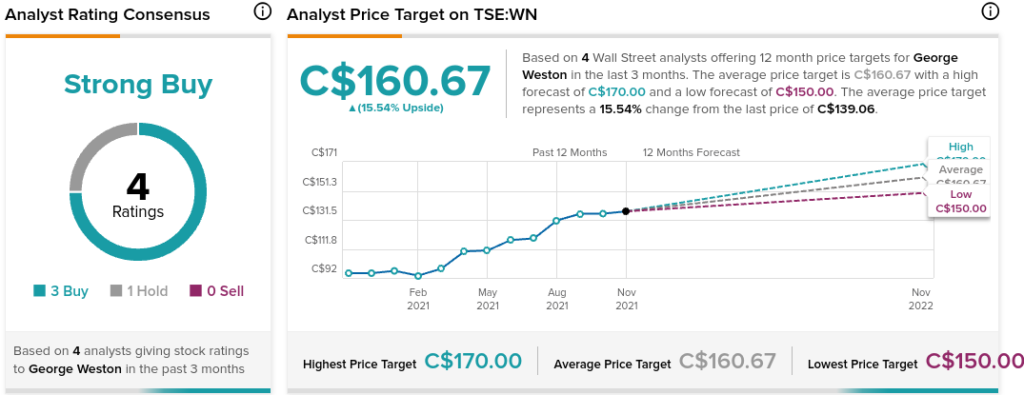

On November 19, BMO Capital analyst Peter Sklar maintained a Hold rating on WN while raising its price target to C$150 (from C$138). This implies 7.9% upside potential.

The rest of the Street is bullish on WN with a Strong Buy consensus rating based on three Buys and one Hold. The average George Weston price target of C$160.67 implies 15.5% upside potential to current levels.

Related News:

Loblaw’s Profit Rises 26% in Q3

High Liner Q3 Profit More than Doubles

Restaurant Brands Q3 Revenue Rises 12%; Shares Plunge