Shares in GenMark Diagnostics (GNMK) are soaring 10% in Wednesday’s pre-market trading after the molecular diagnostics company announced impressive preliminary financial and operational results for the quarter ended June 30, 2020 due to strong sales of COVID-19 test sales.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Second quarter revenue is now expected to be approximately $40.1 million, an increase of 118% over the second quarter of 2019. GNMK is now anticipating ePlex revenue of $35.2 million, up 195% year-over-year.

COVID-19 positively impacted second quarter placements and revenue, the company stated, with approximately 90% of gross placements including interest in COVID-19 testing.

GenMark also revealed that SARS-CoV-2 consumable revenue accounted for approximately 48% of total ePlex revenue.

Gross margin is now expected to be approximately 38% to 39%, compared to 36% in the second quarter of 2019.

During the quarter, the company placed net 71 ePlex analyzers, concluding the quarter with a global installed base of more than 650 ePlex analyzers, an increase of 48% from the same period last year.

“Strong COVID-19 demand continued to drive additional ePlex placements, which provides the foundation for future recurring testing revenues across our broader menu” commented CEO Scott Mendel.

“In addition, we launched our RP2 Panel, which incorporates SARS-CoV-2 onto our existing syndromic panel for respiratory pathogen testing. The RP2 panel also introduces a simplified workflow, making it even easier for hospital labs to run our test” he added.

The GenMark ePlex SARS-CoV-2 Test and ePlex RP2 Panel have been made available under an emergency access mechanism called an Emergency Use Authorization (EUA).

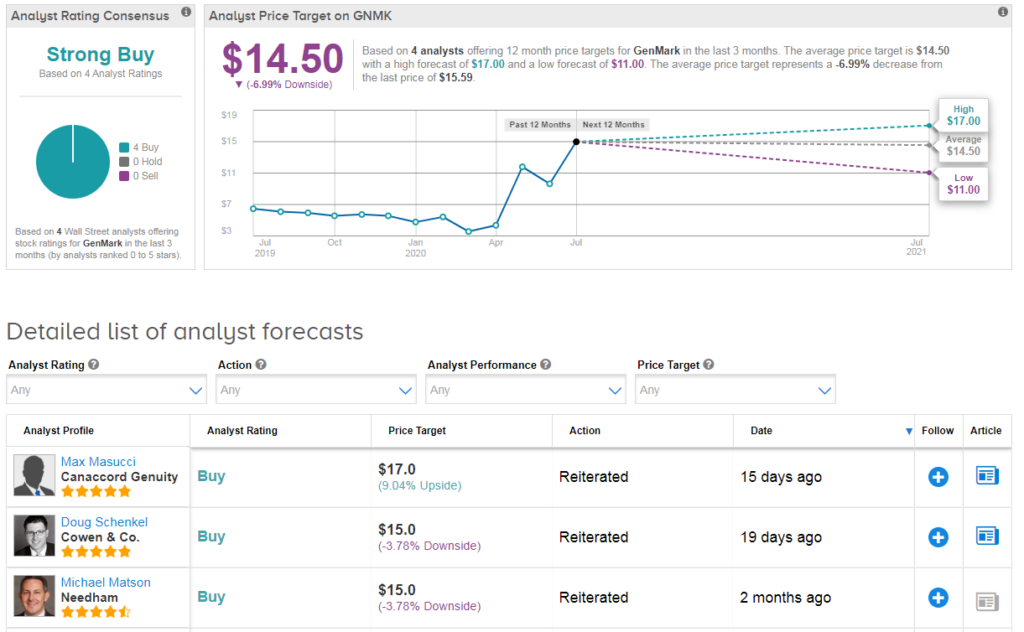

GNMK has rallied 224% year-to-date, and analysts have a bullish Strong Buy consensus on the stock’s outlook. However, thanks to the recent rally, the average analyst price target now indicates downside potential of 7% from current levels. (See GenMark stock analysis on TipRanks).

“The GNMK “story” has changed over the past 6 months, and we believe the stock’s 5.3x forward sales multiple doesn’t fully reflect the company’s 1) growth prospects, 2) improving competitive position and 3) upgraded installed base (quantity and quality of customers)” Canaccord Genuity’s Max Masucci recently told investors. He has a buy rating on the stock and $17 price target.

Related News:

Novavax Spikes 42% Pre-Market On $1.6B U.S. Funding For Covid-19 Candidate

Corvus Shoots Up 115% On Start Of Novel Immunotherapy Study In Covid-19 Patients

Regeneron Up 5% In Pre-Market On Start Of Late-Stage Covid-19 Antibody Trial