GenMark Diagnostics shares jumped 12.6% in the after-market trading hours on Thursday as the company announced strong preliminary results for the third quarter. Separately, the company also announced that its ePlex Respiratory Pathogen Panel 2 (or RP2) has received Emergency Use Authorization from the US FDA.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Currently, GenMark (GNMK) expects its 3Q revenue to rise 104% Y/Y to $42.6 million. The maker of multiplex molecular diagnostic testing systems anticipates a 187% rise in revenue from its ePlex analyzers to $38 million.

Notably, the ePlex RP2 Panel accounted for about 63% of ePlex consumable revenue, reflecting the increased customer conversions from ePlex SARS-CoV-2 to RP2 ahead of the “respiratory season”. GenMark’s ePlex SARS-CoV-2 Test received FDA Emergency Use Authorization back in March.

Meanwhile, the company placed 70 (net) ePlex analyzers in the quarter and ended the period with a worldwide installed base of over 720 ePlex analyzers, marking a 47% growth. Also, 3Q gross margin is expected between 38% to 39% compared to 34% in the prior year’s third quarter. The company will announce its complete 3Q results later this month.

GenMark’s CEO Scott Mendel cheered “We continued to see strong demand for both ePlex systems and consumables, including a significant portion of our customers adopting sample-to-answer syndromic testing for the first time.”

The CEO added that the company’s manufacturing expansion effort is on track to meet its capacity target of 150,000 to 175,000 tests per month by the end of this year and 200,000 per month by the end of 1Q 2021.

Much to the delight of the investors, the company has been granted Emergency Use Authorization by the FDA for its RP2 Panel, which provides test results in less than two hours for more than 20 viruses and bacteria that cause common and often serious respiratory infections, including COVID-19, flu, bronchitis and the common cold.

The company stated that the multiplex or syndromic RP2 Panel “will be essential in preparing for fall and winter as the flu season coincides with the ongoing risk of COVID-19.”

The ePlex RP2 Panel received the CE mark in September, allowing its use for clinical diagnosis in Europe. (See GNMK stock analysis on TipRanks)

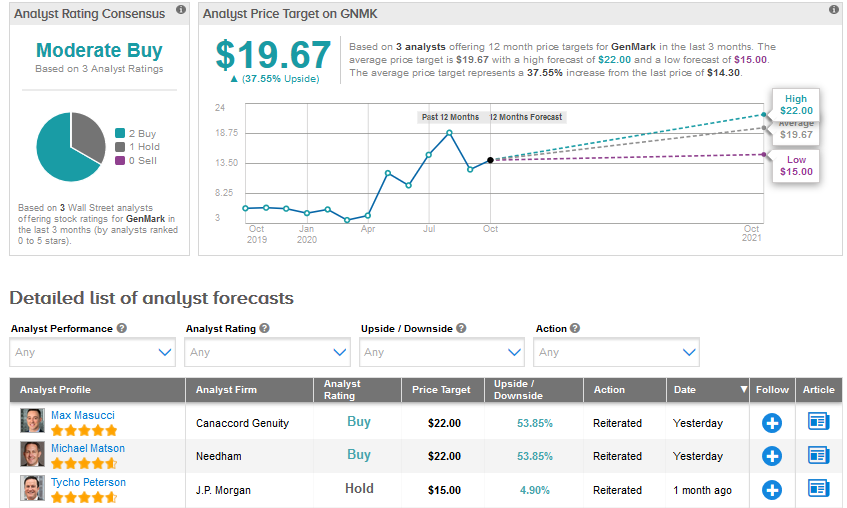

Following Thursday’s updates, Canaccord Genuity analyst Max Masucci reiterated a Buy rating with a price target of $22 for GenMark. The analyst believes that the company’s near-term execution positions it for success beyond the pandemic.

The analyst stated, “For those concerned about a COVID-19 testing revenue “cliff” for GNMK– the importance of customer transitions from GNMK’s single-target COVID-19 test to its RP2 panel cannot be understated. At its core, GNMK is a multiplex molecular diagnostics company, and a key growth driver over the past 2 years (+35% and +24% top-line growth in 2018 and 2019) has been its legacy respiratory pathogen panel.”

“By transitioning customers away from its single-target COVID-19 test, GNMK is de-risking its reliance on pandemic-driven revenues and instead driving interest/adoption of its next-generation growth driver (its RP2 panel), which can detect a wide collection of (20+) respiratory disease causing pathogens that existed well before COVID-19.”

Overall, a Moderate Buy consensus for GenMark is based on 2 recent Buy ratings and 1 Hold rating. GenMark stock has risen a whopping 197% so far in 2020 and the average analyst price target of $19.67 indicates a further upside of about 38%.

Related News:

CareDx Soars 15% As 3Q Revenue Outlook Surpasses Estimates

BioNTech, Rentschler Partner For Covid-19 Vaccine Manufacturing

Gilead Inks EU Supply Deal For 500,000 Remdesivir Doses