General Motors (GM) will collaborate with Westinghouse Air Brake Technologies (Wabtec) (WAB). The two will work together to advance and commercialize the automaker’s battery and fuel cell technologies for use in Wabtec locomotives.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

General Motors designs, builds, and sells cars. It is currently working on advancing an all-electric future that is inclusive and accessible to all.

Wabetc will merge its know-how in energy and systems optimization with GM’s advanced technologies to develop solutions for heavy haul locomotives. The automaker’s Ultium battery technology is expected to offer flexibility, efficiency, power, and reliability for use in the rail system. Its compact fuel cell power cubes can be used in several applications including locomotives. (See General Motors stock analysis on TipRanks)

Additionally, Wabtec and GM have inked a non-binding agreement through which they will advance each other’s vision of zero-emission in transportation. The development is expected to accelerate the rail industry’s path to decarbonization while ensuring zero-emission from locomotives. (See Westinghouse Air Brake Technologies stock analysis on TipRanks)

“Rail networks are critical to transportation and to GM’s ability to serve our customers across North America, and Wabtec’s bold plan to de-carbonize heavy haul and other locomotive applications helps advance our vision of a world with zero crashes, zero emissions and zero congestion,” said Mark Reuss, GM’s President.

Barclay’s analyst Brian Johnson has reiterated a Buy rating on the stock and raised the price target to $70 from $66, implying 15.1% upside potential to current levels. According to the analyst, the raising of second-quarter and full-year upper-end guidance affirms solid execution at the automaker.

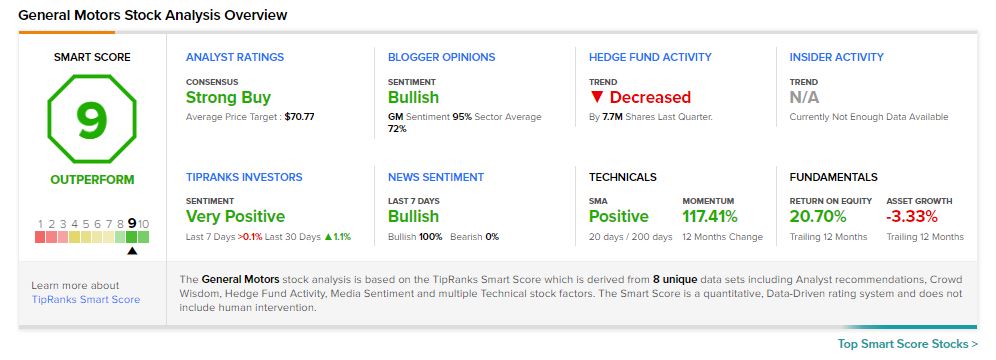

Consensus among analysts is a Strong Buy based on 12 Buys and 2 Holds. The General Motors average analyst price target of $70.77 implies 16.38% upside potential to current levels.

GM scores 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Why Nio Stock is Trading Higher?

Labcorp And OmniSeq Unveil INSIGHT, Next-Generation Sequencing Test to Boost Precision Oncology

Why is Clover Health Stock Falling?