Shares of global automaker General Motors Co. (GM) reached a new all-time high of $65.98, after the company released its fourth-quarter and full-year delivery details.

Moreover, investors were intrigued by GM’s plan to unveil the new Electric Silverado pickup truck at the Consumer Electronics Show on Wednesday. Meanwhile, GM shares soared 7.5% to close at $65.74 on January 4.

Delivery Update

GM said it delivered 440,745 vehicles in the fourth quarter, a 43% year-over-year decline compared to Q4 of FY2020, which was GM’s best quarter for retail sales since 2007.

However, an improving chip supply boosted GM’s Q4 production and wholesale deliveries compared to Q3. GM had 199,662 vehicles in dealer inventory, including in-transit, up 55% at the end of Q4 compared to the levels in the third quarter.

For the full year 2021, GM delivered 2.2 million vehicles. The year ended with Chevrolet and GMC taking the lead in the combined full-size and midsize pickup sales for the eighth consecutive year. However, the sales declined 13% year-over-year due to semiconductor shortages related to the COVID-19 pandemic.

Yet, going ahead, GM is positive about its inventory levels and said that it has managed to tackle the supply chain issues effectively.

According to J.D. Power PIN estimates, GM had approximately 39% retail market share in 2021 and has been the leader in retail sales in the full-size pickup segment repeatedly since 2003.

Meanwhile, GM lost its leading position in 2021 to Toyota Motor Corp. (TM) which delivered a total of 2.3 million vehicles in 2021.

Company Comments

Steve Carlisle, Executive Vice President of GM, and President of GM North America, said, “In 2022, we plan to take advantage of the strong economy and anticipated improved semiconductor supplies to grow our sales and share. We will also further strengthen our industry leadership in trucks and begin our drive to EV leadership in North America with the rollouts of the GMC HUMMER EV, Cadillac LYRIQ, and the reveals of the Chevrolet Silverado EV and GMC Sierra EV.”

The company’s Chief Economist, Elaine Buckberg, said, “Consumers want to drive as much as before the pandemic, based on recent high levels of vehicle usage. High vehicle usage and deferred sales mean pent-up demand for new vehicles in the millions and building. That pent-up demand will support sales as vehicle supply improves.”

Analysts’ Take

Yesterday, Wedbush analyst Daniel Ives reiterated a Buy rating on the stock with a price target of $85, which implies 29.3% upside potential to current levels.

Commenting on GM’s Chevrolet Silverado E, which will be unveiled at the CES, Ives said, “With the Hummer already out at the high end of the market, we believe the Silverado E is a breakthrough electric truck platform that speaks to the massive innovation going on for GM in the 313-area code.”

The analyst added, “We view tomorrow as kicking off a renaissance of growth for GM with 2022 a pivotal year ahead as this green tidal wave plays out globally.”

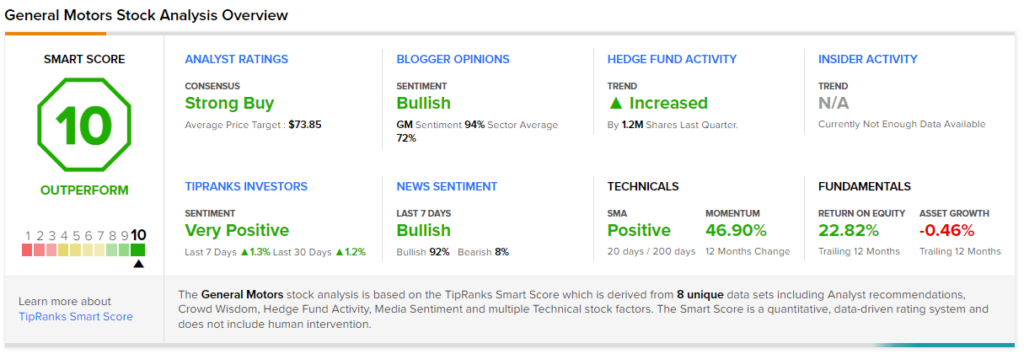

Wall Street’s Top Analysts have awarded GM a Strong Buy consensus rating based on 11 Buys and 3 Holds. The average General Motors price target of $73.85 implies 12.3% upside potential to current levels. Shares have gained 57.8% over the past year.

Smart Score

According to TipRanks’ Smart Score rating system, General Motors scores a “Perfect 10” which indicates that the stock has strong potential to outperform market expectations. General Motors is one of the Best Electric Vehicle Stocks with a high growth potential for 2022.

Download the mobile app now, available on iOS and Android.

Related News:

Roku is U.S. No.1 Smart TV Operating System; Partners with Sharp

Chipotle Offers Limited Time Plant-Based Chorizo; Shares Slip

U.S. Approves Pfizer-BioNTech COVID-19 Booster for 12-15 Year Old Teens

Questions or Comments about the article? Write to editor@tipranks.com