General Motors announced the recall of certain Chevrolet Bolt EVs over potential fire risks. The automaker said that the voluntary recall is related to select vehicles manufactured between 2017 and 2019 which are equipped with batteries manufactured by LG Chem’s Ochang, South Korea facility.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company noted that the cars’ batteries may “pose a risk of fire when charged to full, or very close to full, capacity.” As per a Reuters report, General Motors is recalling 68,677 Chevrolet Bolt EVs.

General Motors (GM) has advised owners of this model to limit the vehicles’ charge to 90% to reduce the fire risk. The company noted that it will be providing necessary software updates to dealers starting November 17 to automatically limit battery charge to 90%. (See GM stock analysis on TipRanks).

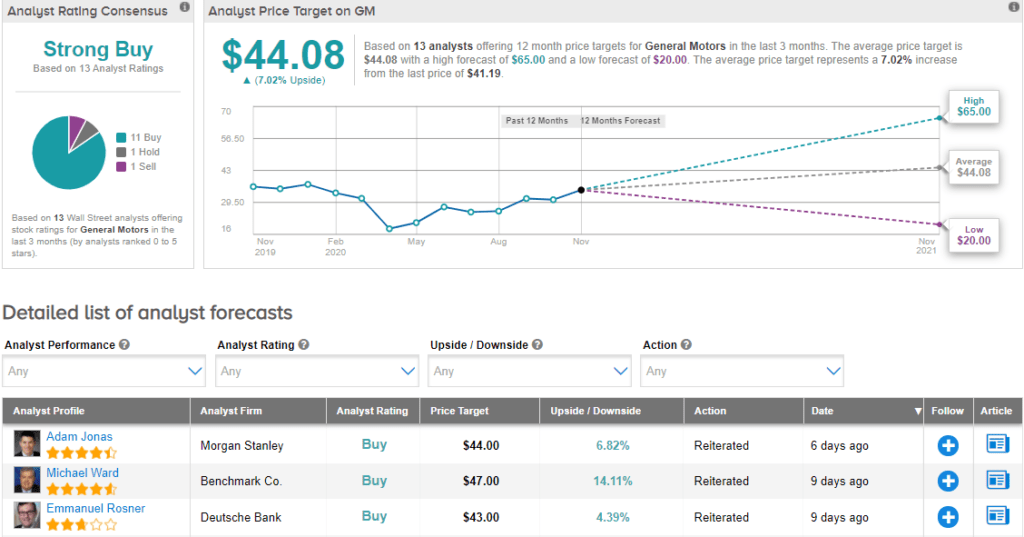

On November 6, Benchmark Co. analyst Michael Ward raised the stock’s price target to $47 (14.1% upside potential) from $41 and reiterated a Buy rating following the company’s 3Q earnings release. Ward noted that the 3Q results benefited from better-than-expected sales in North America, positive pricing and low inventory levels. The analyst believes these factors should lead to strength in the first half of fiscal 2021.

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 11 Buys, 1 Hold and 1 Sell. The average price target stands at $44.08, implying upside potential of about 7% from current levels. Shares are up by about 12.5% year-to-date.

Related News:

Ford Rolls Out First Electric Commercial Cargo Van; Street Says Hold

Fiat Chrysler, Engie Join Forces For E-Mobility Joint Venture

Ford Targets Sale Of 100,000 Hands-Free Cars In First Year