General Motors (GM) has inked a strategic supplier agreement with Wolfspeed, Inc. (WOLF). The agreement paves the way for the development of silicon carbide power devices to be used in the automaker’s future electric vehicle (EV) programs. GM shares rose 1.60% to close at $53.98 on October 4.

General Motors is a global company that designs, builds, and sells cars, trucks, crossovers, and automobile parts. It is also engaged in advancing an all-electric future.

The use of silicon carbide devices should allow General Motors to develop more efficient electric vehicle propulsion systems. The strategic supplier agreement marks an important milestone in General Motors’ push to transition to an all-electric future. The company’s Vice President for Global Purchasing and Supply Chain, Shilpan Amin, expects the alliance to accelerate the delivery of electric vehicles.

Currently, Silicon Carbide is being adopted as an industry-standard semiconductor and continues to accelerate the industry’s transition to clean energy vehicles. The benefits of using silicon carbide include the reduction of weight and the conservation of space, resulting in a longer EV range. (See General Motors stock charts on TipRanks)

“Customers of EVs are looking for greater range, and we see silicon carbide as an essential material in the design of our power electronics to meet customer demand,” Amin said.

In addition, General Motors will participate in the Wolfspeed Assurance of Supply Program. The program seeks to secure sustainable and scalable materials for electric vehicle production.

Last month, Morgan Stanley analyst Adam Jonas reiterated a Buy rating on General Motors with an $80 price target, implying 48.20% upside potential to current levels. According to the analyst, the automaker will attempt to position itself as a transportation technology platform.

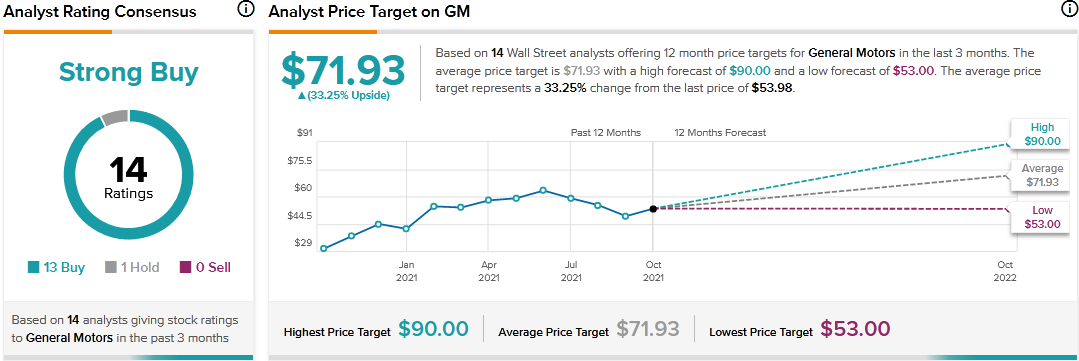

Consensus among analysts is a Strong Buy based on 13 Buys and 1 Hold. The average General Motors price target of $71.93 implies 33.25% upside potential to current levels.

Related News:

Accuray Inks Deal with C-RAD to Enhance Breast Cancer Treatment

Verizon, CareAR Join Hands to Enhance Customer Experience

Lululemon Athletica Expands Stock Repurchase Program by $500M