Things weren’t looking good for General Motors (NYSE:GM), as its aspirations of a self-driving taxi service hit the skids in California. However, given that GM shares are up fractionally in Wednesday afternoon’s trading session, the news may not be as bad as some might have feared.

Just yesterday, California pulled the licenses on GM’s Cruise lineup of robotaxis. That, in turn, sparked an avalanche of concern about the loss of the entire self-driving car industry. Indeed, the fears in question weren’t completely unfounded; after all, the reason the GM Cruise lost its license in California was that it hit a pedestrian back on October 2, just two months after the Cruise got a license to begin with. Worse, reports note, it didn’t merely hit a person but also dragged that person along the roadway for about 20 feet.

It got worse from there; the Department of Motor Vehicles in California declared that not only are the vehicles not safe for public use, but also that GM “misrepresented” safety information. In fact, GM only supplied video about the collision, reports note. Word about the dragging following the car’s attempt to pull over took an additional nine days to procure.

Now, GM is left to either appeal the decision or otherwise demonstrate how it’s addressing “deficiencies” in the technology to get its permits back. Either way, this isn’t good news for the autonomous driving industry.

Is GM a Good Stock to Buy?

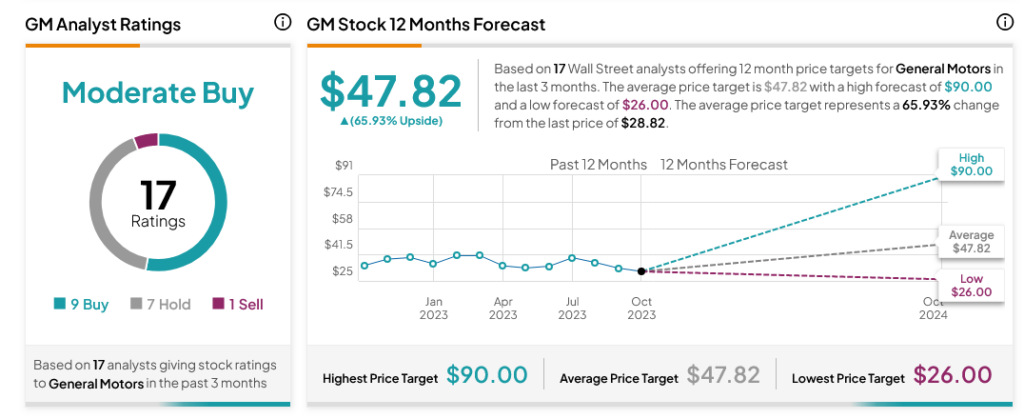

Turning to Wall Street, analysts have a Moderate Buy consensus rating on GM stock based on nine Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average GM price target of $47.82 per share implies 65.93% upside potential.