We all know that most of the legacy automakers like General Motors (GM) have been pushing back their green aspirations. Electric cars—and electric car infrastructure—are just not where they need to be yet. There are signs that advances are being made, though investors have not been sensing the progress at all. GM shares were down over 3% in Monday afternoon’s trading.

The latest electric vehicle sales data shows that there is a clear increase in EV sales for GM, and that uptick has run all the way through August. Objectively, the numbers are sound—GM sold about 21,000 electric vehicles in July and August—and the comparisons are decent. The July / August sales are almost equivalent to GM’s electric vehicle sales in the second quarter.

However, there is the matter of comparison to consider here. GM sold roughly 903,000 vehicles to dealers during the second quarter of 2024. That number overwhelms its EV sales numbers handily. Still, with GM’s EV numbers gaining, it is now within striking distance of Ford’s (F) EV sales. Both are reporting numbers that are still quite light, but there are gains being made.

A Roadblock Ahead

This is all underscored, however, by the news that GM is poised to launch layoffs at a plant in Kansas. The Fairfax Assembly plant is set to lose 1,695 workers, noted a Worker Adjustment and Retraining Notification (WARN) notice issued by the company. The first round of layoffs will occur November 18, 2024, with 250 temporary employees outright lost and 686 full-time workers temporarily laid off.

The second round of layoffs will follow on January 12, 2025, with another 759 workers temporarily laid off. Reasons for these job losses are unclear, but earlier reports suggested that the Cadillac XT4 would go into a paused production state. However, later in 2025, the Fairfax plant would shift to making not only XT4s, but also the Bolt EV. Thus, the layoffs here may indeed turn out to be temporary while GM retools the plant and gets it ready for the new line.

Is GM Stock a Buy or Hold?

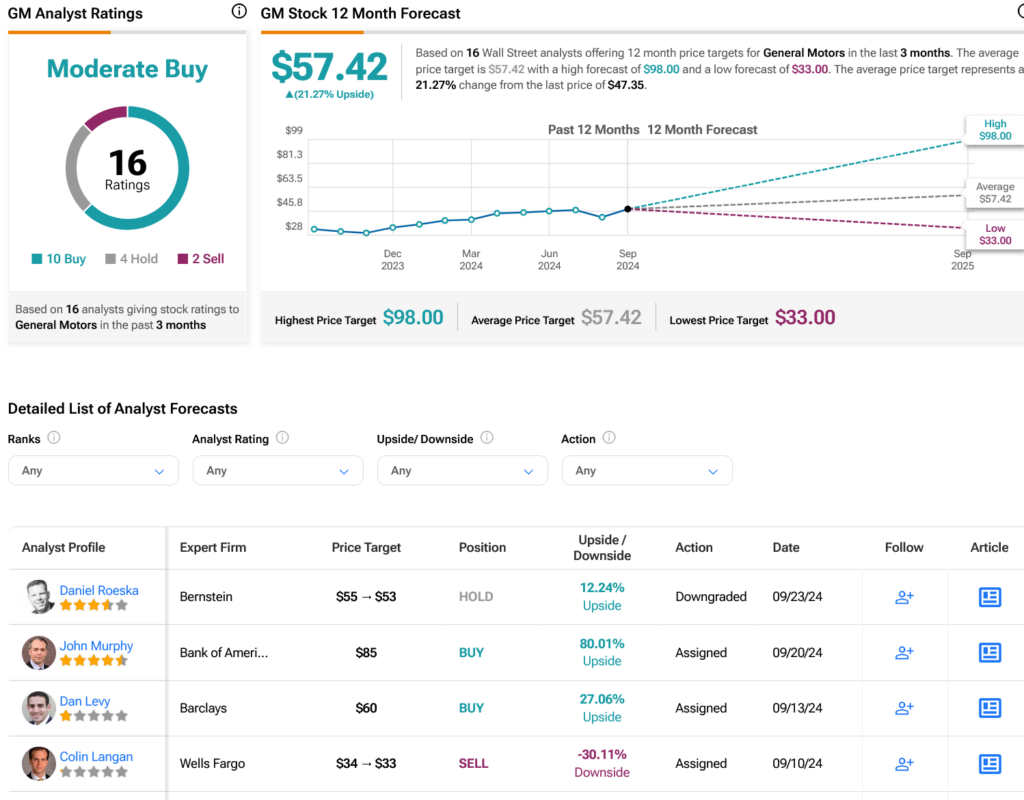

Turning to Wall Street, analysts have a Moderate Buy consensus rating on GM stock based on 10 Buys, four Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 44.4% rally in its share price over the past year, the average GM price target of $57.42 per share implies 21.27% upside potential.