Automotive major General Motors Co. (NYSE: GM) reported third quarter earnings of $2.28 per share, up by 1.3% year-over-year and surpassing analysts’ consensus estimate of $1.87 per share. The company generated revenues of $44.1 billion, increasing 5.4% year-over-year and beating analysts’ expectations of $42.5 billion.

According to GM’s CFO Paul Jacobson, the United Auto Workers (UAW) strike that started in September this year has cost the automaker around $800 million in pre-tax earnings due to stalled vehicle production, including $200 million during the third quarter.

As a result, GM pulled its prior earnings guidance for FY23, which had forecasted adjusted earnings in the range of $12 billion to $14 billion.

However, management expects its cost savings to continue and anticipates a reduction in fixed costs of $2 billion by 2024. GM expects its EV margin to be in the “low to mid-single-digit” in 2025. The company has forecast battery cell production to increase at its Ohio plant, with the facility likely to reach full capacity by the end of this year. By the end of 2025, GM has forecast its annual electric vehicle capacity to reach 1 million units in North America.

Is GM a Good Stock to Buy?

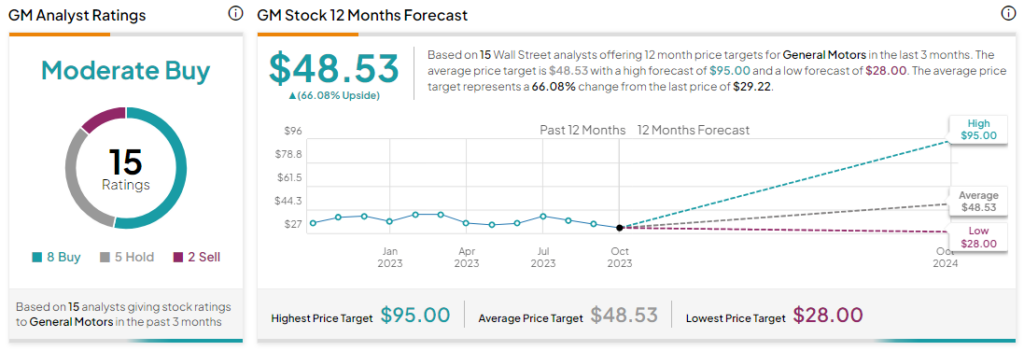

Overall, analysts are cautiously optimistic about GM stock with a Moderate Buy consensus rating based on eight Buys, five Holds and two Sells. The average GM price target of $48.53 implies an upside potential of 66.1% at current levels.