American multinational conglomerate General Electric Co. (GE) fell 5.9% after the company gave business highlights and updates for the first quarter of fiscal 2022, which had a cautionary tone. Shares closed at $92.69 on February 18.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company issued the business updates in response to several investors and analysts’ questions regarding the company’s performance to date in the current quarter.

Cautionary Outlook

GE mentioned that three of its segments, namely aviation, healthcare, and renewable energy will, continue to face the brunt of the ongoing supply chain and labor issues, and inflationary environment.

Commenting on the same, the company’s Vice President of Investor Relations, Steven Winoker, said, “Although varied by business, we expect these challenges to persist at least through the first half of the year.”

The company also added that although the impact from these headwinds is included in its full-year fiscal 2022 outlook, GE continues to experience persistent pressures from them.

In light of the same, the company said that its FY22 overall growth, profit, and Free Cash Flows (FCF) will be adversely impacted, significantly more than the typical seasonal impact in both the first quarter and first half of 2022.

In response to the headwinds, the company is undertaking measures to mitigate their impact. Winoker said, “Supply chain headwinds may continue to partially mask the significant progress we are making across our businesses. Nonetheless, we continue to see that progress on multiple fronts, including how we run our operations with a lean mindset, rallying around SQDC (Safety, Quality, Delivery and Cost), and delivering for our customers. We are focused on mitigating these pressures through pricing and cost actions, and with lean.”

The company also mentioned that lean is improving its first-time yields in Aviation. Meanwhile, sourcing alternative parts is helping circumvent shortages in Healthcare, and selective deals with adequate prices are helping curb the inflationary pressure in Renewable Energy.

Furthermore, General Electric CEO Larry Culp will provide updates and details on the company’s progress at the upcoming Barclays and Citi Industrial conferences, and at GE’s 2022 Investor Day, which is scheduled for March 10.

The company has guided for FY22 earnings per share (EPS) to fall in the range of $2.80 to $3.50 per share, and FCF is expected to be between $5.5 billion and $6.5 billion.

Meanwhile, FY22 organic revenue growth is expected to grow in the high single digits, and organic margin expansion of 150bps+ is projected.

Analysts’ Take

Wall Street analysts do not believe the business update has any impact on the 2022 outlook, and maintained their optimistic view on the GE stock and kept their model estimates unchanged for FY22 and FY23.

According to Citigroup Analyst Andrew Kaplowitz, who has a Buy rating and a price target of $125 (34.9% upside potential), in FY21, the Q1 EPS made about 8% of the full-year EPS. Similarly, despite magnified impacts, Kaplowitz does not expect the Q1 EPS to have a material impact on the full-year EPS projections.

On a similar note, Wolfe Research analyst Nigel Coe mentioned that GE’s business comments neither threaten its EPS forecast nor do they signify any significant deterioration in ground conditions. Coe maintained his Buy rating and $127 price target on the stock, which implies 37% upside potential to current levels.

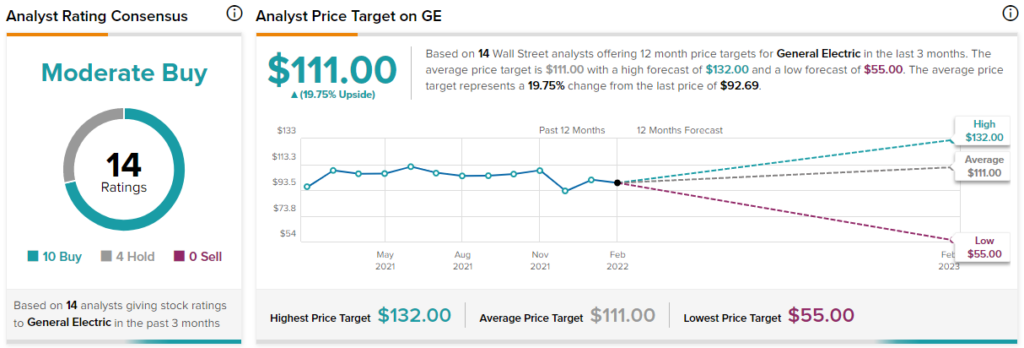

Overall, the GE stock has a Moderate Buy consensus rating based on 10 Buys and 4 Holds. The General Electric stock prediction of $111 implies 19.8% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Roku Plunges 22% on Q4 Revenue Miss and Weak Guidance

Tesla Drops 5% on Phantom Braking Complaint, Mustang Mach E Takes Top Spot

U.S. Adds AliExpress and WeChat to Notorious Markets List – Report