Shares of aerospace and defense company General Dynamics Corp. (GD) have gained 30.3% over the past 12 months. GD’s recent fourth-quarter numbers were a mixed bag with its top-line lagging estimates.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Revenue declined 1.8% year-over-year to $10.29 billion, falling short of estimates by $401.5 million. Earnings per share at $3.39, on the other hand, came in ahead of expectations by $0.02. Notable, at the end of this period, the total backlog with GD stood at $87.6 billion and the estimated potential contract value stood at $39.9 billion.

Further, GD also bagged an $829 million IT services contract from the Defense Intelligence Agency in February. With these developments in mind, let us take a look at the changes in GD’s key risk factors that investors should know.

Risk Factors

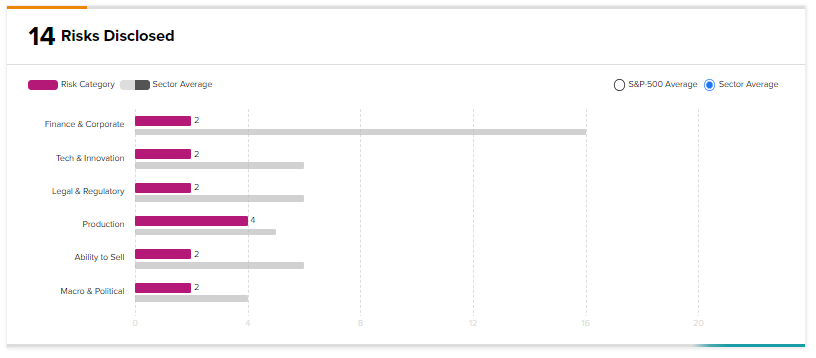

According to the TipRanks Risk Factors tool, General Dynamics’ top risk category is Production, contributing 4 of the total 14 risks identified for the stock.

In its recent report, the company has added one key risk factor under the Legal & Regulatory risk category. Compared to a sector average of 6 risk factors, GD has 2 risk factors under Legal & Regulatory category.

GD highlighted that there is higher public awareness and concern associated with global climate change. This may lead to requirements to reduce or mitigate global warming, which can include carbon pricing mechanisms or limits on greenhouse gas emissions. These requirements may mean higher costs and capital expenditures, compliance requirements, and operational restrictions for GD. As a result, GD may witness lower margins and an adverse impact on its financials.

Hedge Fund Activity

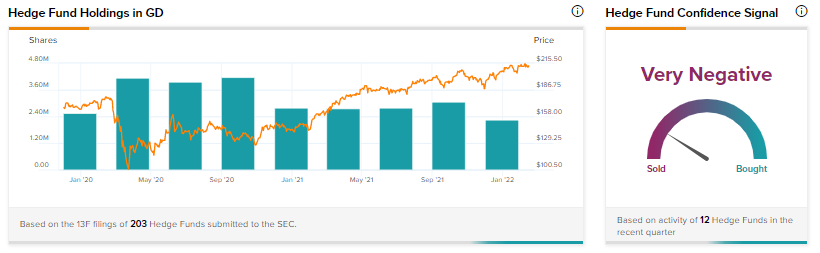

According to TipRanks data, the Wall Street’s top hedge funds have decreased holdings in General Dynamics by 813.5 thousand shares in the last quarter, indicating a very negative hedge fund confidence signal in the stock based on activities of 12 hedge funds. Notably, Joel Greenblatt’s Gotham Asset Management has a holding worth about $11.7 million in GD.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Neurocrine Biosciences Up 7.5% Despite Q4 Miss

Mr. Cooper Group Gains 19% on Q4 Earnings Beat & New Partnership

Green Plains Tanks 9% on Wider-Than-Expected Q4 Loss