Generac Holdings (NYSE: GNRC) shares jumped 14.4% on February 16, after the manufacturer of generators and power equipment delivered a blowout fourth-quarter results. Driven by robust performance across all segments and regions, GNRC exceeded both earnings and revenue estimates .

The quarterly beat was also driven by robust demand and capacity expansion, leading to record quarterly shipments and production levels despite ongoing supply chain challenges.

The company also provided upbeat FY2022 guidance and predicts another year of exceptional revenue growth.

Q4 Beat

Adjusted earnings of $2.51 per share grew 18.4% year-over-year and were 11 cents ahead of analysts’ expectations of $2.40 per share. The company reported earnings of $2.12 per share for the prior-year period.

Further, net sales jumped 40% year-over-year to $1.07 billion and exceeded consensus estimates of $1.02 billion. The increase in revenues reflected robust core sales growth, which increased 35%, excluding acquisitions and currency effects.

Segment-wise, Residential product sales grew 42% to $706 million, while Commercial & Industrial (C&I) product sales jumped 43% to $284 million during the fourth quarter.

Upbeat FY2022 Outlook

Based on robust Q4 results and continuing robust global demand for C&I products, and recent acquisitions, management issued the financial guidance for FY2022.

The company forecasts net sales year-over-year growth in the range of 32% to 36%, including 5% to 7% contributions from the net impact of acquisitions and foreign currency.

Furthermore, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) margin is forecast to be in the range of 22% to 23% before deducting for non-controlling interests.

CEO Comments

GNRC CEO, Aaron Jagdfeld, said, “We enter 2022 with considerable visibility and momentum given ongoing robust home standby demand, an expanding Energy Technology solutions portfolio, and strong global demand for our C&I products.”

He further added, “Our strong balance sheet and cash flow generation give us the confidence to make the necessary investments to further capitalize on the key mega-trends that support our long-term growth outlook.”

Analysts Recommendation

Overall, the stock has a Strong Buy consensus rating based on 11 unanimous Buys. The average Generac Holdings stock forecast of $456.91 implies 44.39% upside potential from current levels.

Investors Weigh In

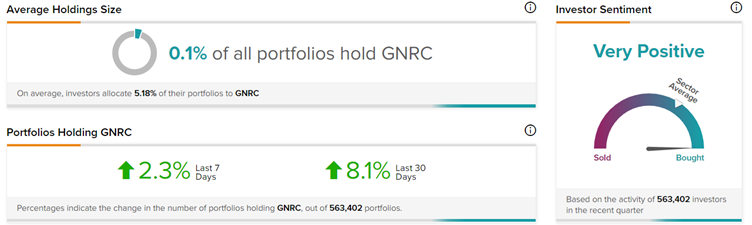

According to TipRanks’ Stock Investors tool, investors currently have a Very Positive stance on Generac Holdings, with 8.1% of investors increasing their exposure to GNRC stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Marriott International Q4 EPS Grows Over 10x; Shares Up 5.8%

Huntsman Beats Q4 Expectations; Shares Rise 8.1%

Sabre Posts Upbeat Q4 Revenues & FY2022 Outlook; Shares Up 21.9%