General Electric has agreed to pay a $200 million penalty to settle charges related to the disclosure failures in its power and insurance businesses, which misled investors, the Securities and Exchange Commission said.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

“In 2017 and 2018, GE’s stock price fell almost 75% as challenges in its power and insurance businesses were disclosed to the public,” the SEC wrote in a statement.

As part of the settlement and in addition to the penalty fee, GE (GE) has also agreed to report to the SEC for a one-year period about accounting and disclosure controls in its insurance and power businesses.

According to the SEC’s order, GE misled investors by describing the profits at its GE Power division without explaining that one-quarter of profits in 2016 and nearly half in the first three quarters of 2017 stemmed from reductions in its prior cost estimates. In addition, the SEC also found that GE failed to tell investors that its reported increase in current industrial cash collections was coming at the expense of cash in future years and that it came primarily from internal receivable sales between GE Power and GE’s financial services business, GE Capital.

Furthermore, the SEC alleged that from 2015 to 2017, GE reduced projected costs for claims against its long-term care insurance portfolio and failed to inform investors of the corresponding uncertainties resulting from lower estimates of future insurance liabilities at a time of rising costs from long-term health insurance claims.

“Investors are entitled to an accurate picture of a company’s material operating results,” said SEC’s Stephanie Avakian. “GE’s repeated disclosure failures across multiple businesses materially misled investors about how it was generating reported earnings and cash growth as well as latent risks in its insurance business.”

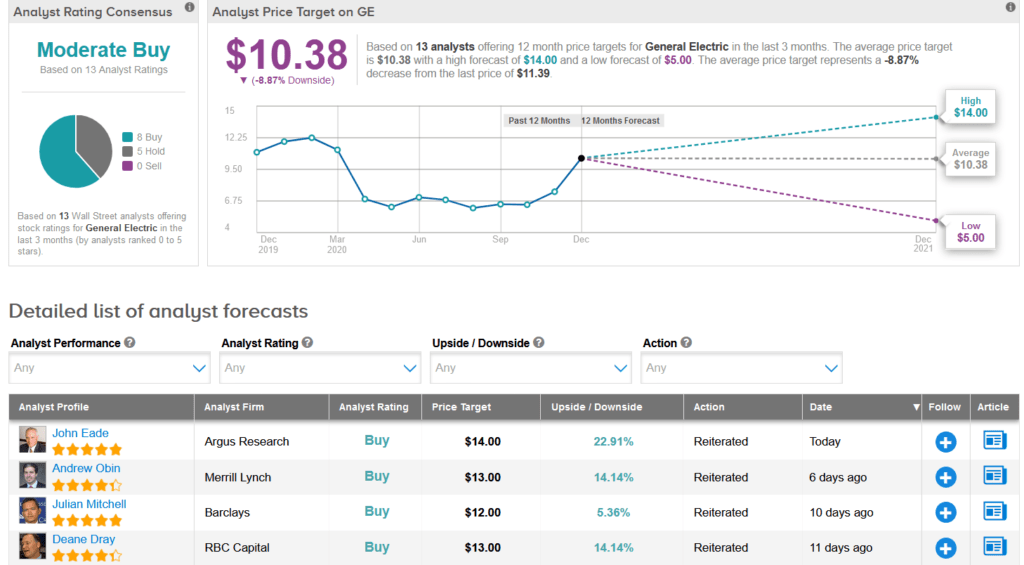

Meanwhile, Argus analyst John Eade today raised the stock’s price target to a Street-high of $14 (23% upside potential) from $10 and reiterated a Buy rating, citing the new CEO Lawrence Culp’s increased focus on cost reduction and cash preservation during the Covid-19 pandemic.

Eade is confident that the GE turnaround under Culp’s helm will lead to “better cash flow, higher earnings, and higher multiple.” (See GE’s stock analysis on TipRanks).

GE shares have jumped 31% over the past month, taking this year’s gain to 2%. That’s with a Moderate Buy analyst consensus led by 8 Buy ratings versus 5 Hold ratings. The average price target of 10.38 indicates downside potential of 9% over the next 12 months.

Related News:

Stratasys Gains On $100M Origin Deal; Needham Sticks To Hold

Biogen Files For Japan Approval Of Potential Alzheimer Treatment; Street Says Hold

RH Crushes 3Q Earnings Estimates; Wells Fargo Boosts PT