Aerospace and renewable energy conglomerate GE (NYSE:GE) increased in pre-market trading on Tuesday after the company reported earnings for its third quarter of Fiscal Year 2023. The company swung to a profit in the Fiscal third quarter with adjusted earnings of $0.82 per share as compared to an adjusted loss of $0.17 per share, which beat analysts’ consensus estimate of $0.56 per share.

The company posted adjusted revenues of $16.5 billion, up by 18% year-over-year on an organic basis. This surpassed analysts’ expectations of $15.5 billion.

GE Chairman and CEO and GE Aerospace CEO H. Lawrence Culp, Jr. commented, “At GE Vernova, our Grid and now Onshore Wind businesses were both profitable this quarter and we expect their performance to continue to improve. With our two largest Renewable Energy businesses delivering and Power’s continued strength, we remain highly confident in GE Vernova’s spin-off next year.”

Looking forward, management raised its FY23 outlook and now anticipates organic revenues to grow in low teens, with adjusted earnings likely to be between $2.55 and $2.65 per share. For reference, analysts had anticipated earnings of $2.34 per share.

Is GE Stock a Good Buy Now?

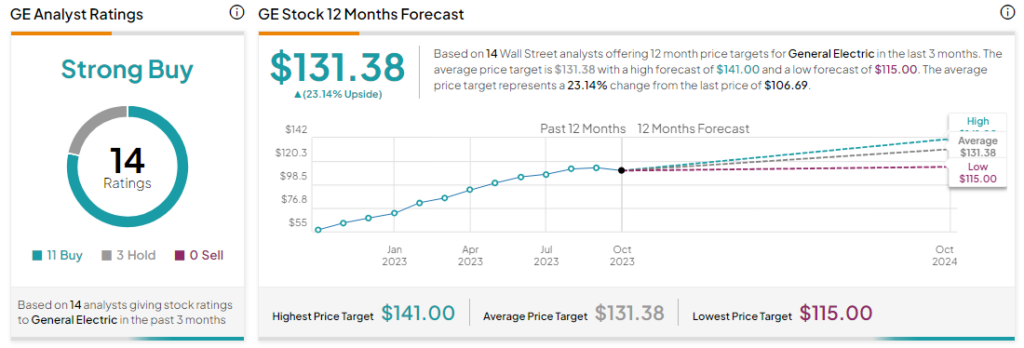

Overall, analysts are bullish about GE stock with a Strong Buy consensus rating based on 11 Buys and three Holds. The average GE price target is $131.38, implying an upside potential of 23.1% at current levels.