GE Aerospace (NYSE:GE) announced better-than-expected Q1 results on Tuesday. The company’s consolidated results include the operations of both GE Aerospace and its energy business, GE Vernova (NYSE:GEV). GE Vernova was spun-off from GE after the end of the first quarter on April 2, 2024, and will report its results on April 25, 2024.

The consolidated results showed that GE generated adjusted revenues of $15.2 billion in the first quarter, up by 10% year-over-year on an organic basis. Analysts were expecting Q1 revenues of $15.3 billion. Adjusted earnings came in at $0.82 per share, surpassing consensus estimates of $0.65 per share.

On a standalone basis, GE Aerospace generated adjusted revenues of $8.1 billion, a growth of 15% year-over-year. The company reported operating profit of $1.5 billion, up by 24% year-over-year and clocked orders worth $11 billion in Q1, up by 34% year-over-year.

GE’s Future Guidance

Based on a strong start to the year, GE Aerospace raised its FY24 guidance and now expects operating profit to range from $6.2 billion to $6.6 billion as compared to its prior forecast between $6 billion and $6.5 billion. Adjusted earnings are likely to range from $3.80 to $4.05 per share in FY24.

Is GE a Good Buy Right Now?

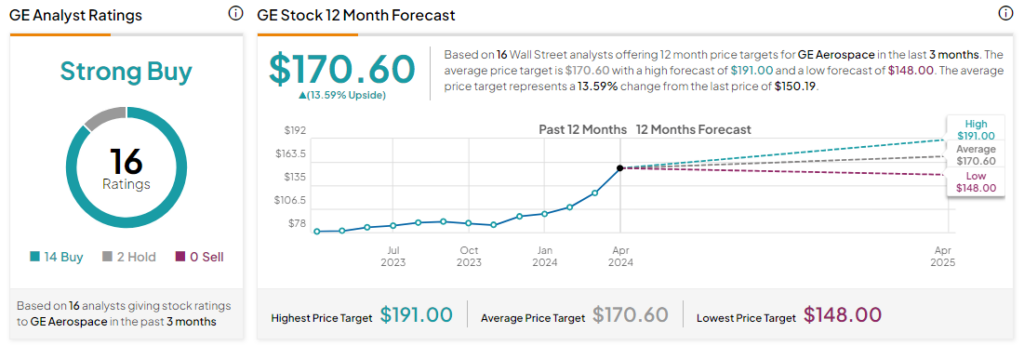

Analysts remain bullish about GE stock, with a Strong Buy consensus rating based on 14 Buys and two Holds. Year-to-date, GE has soared by more than 45%, and the average GE price target of $170.60 implies an upside potential of 13.6% from current levels. These ratings are likely to change following GE’s earnings today.